By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

DEFINITION

***

***

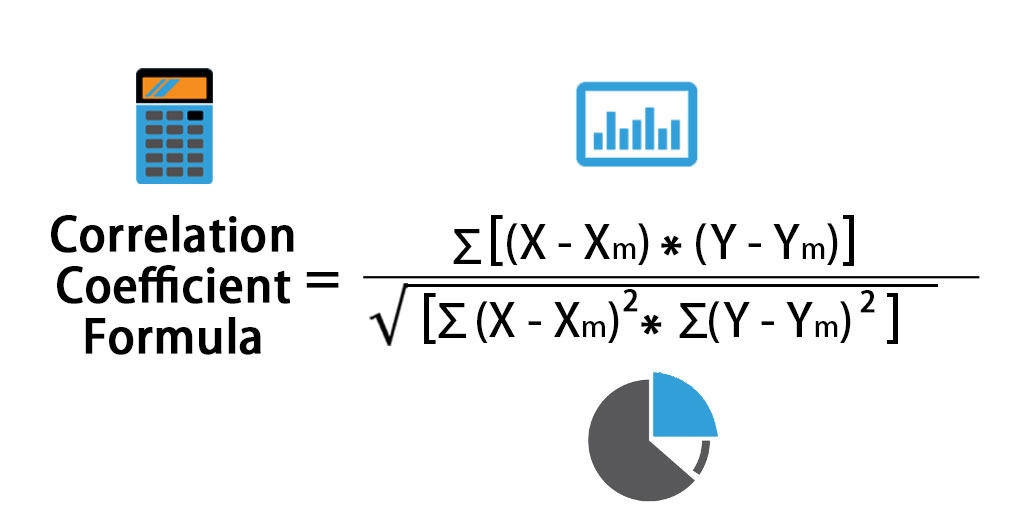

Correlation measures the relationship between two investments–the higher the correlation, the more likely they are to move in the same direction for a given set of economic or market events. Correlation, in the finance and investment industries, is a statistic that measures the degree to which two securities move in relation to each other. Correlations are used in advanced portfolio management, computed as the correlation coefficient which has a value that must fall between -1.0 and +1.0.

So if two securities are highly positively correlated, they will move in the same direction the vast majority of the time. Negatively correlated investments do the opposite–as one security rises, the other falls, and vice versa. No correlation means there is no relationship between the movement of two securities–the performance of one security has no bearing on the performance of the other.

CAUSATION: https://medicalexecutivepost.com/2024/06/05/correlation-is-not-causation/

Correlation is an important concept for portfolio diversification--combining assets with low or negative correlations can improve risk-adjusted performance over time by providing a diversity of payouts under the same financial conditions.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Funding Basics, Glossary Terms, Healthcare Finance, iMBA, Inc., Investing, Marcinko Associates | Tagged: causation, correlation, correlation coefficient, economy, finance, iMBA, Investing, investments, Marcinko, Medical Business Advisors Inc, medical executive post, negative corelation, personal-finance, positive corelation, statistics, stocks |

Leave a comment