By Staff Reporters

***

***

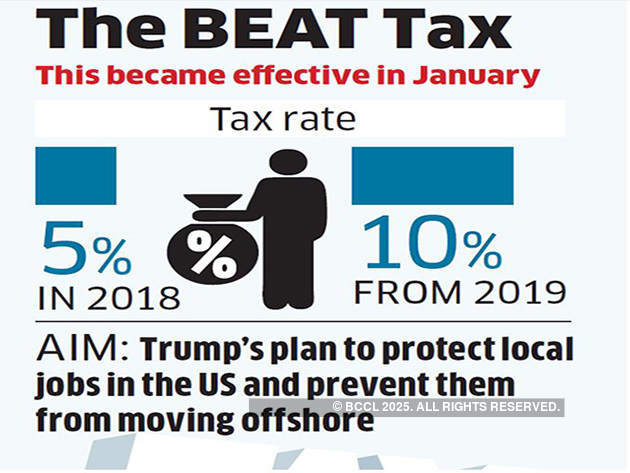

Base-Erosion Anti-Abuse Tax (BEAT): The 2017 tax reforms moved the U.S. from a worldwide taxation system to a quasi-territorial system, so foreign earnings are no longer included in a company’s domestic tax base.

To discourage companies operating in the U.S. from avoiding tax liability by shifting profits out of the country, Congress imposed a 10% minimum tax called Base-Erosion Anti-Abuse Tax (BEAT). The BEAT rate will increase from 10% to 12.5% in 2026.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, iMBA, Inc., Taxation, Touring with Marcinko | Tagged: AIM, Base-Erosion Anti-Abuse Tax (BEAT), BEAT, BEAT tax, finance, Investing, IRS, Marcinko, politics, tax, tax liability, taxes, Trump |

Leave a comment