By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

DEFINITIONS

***

***

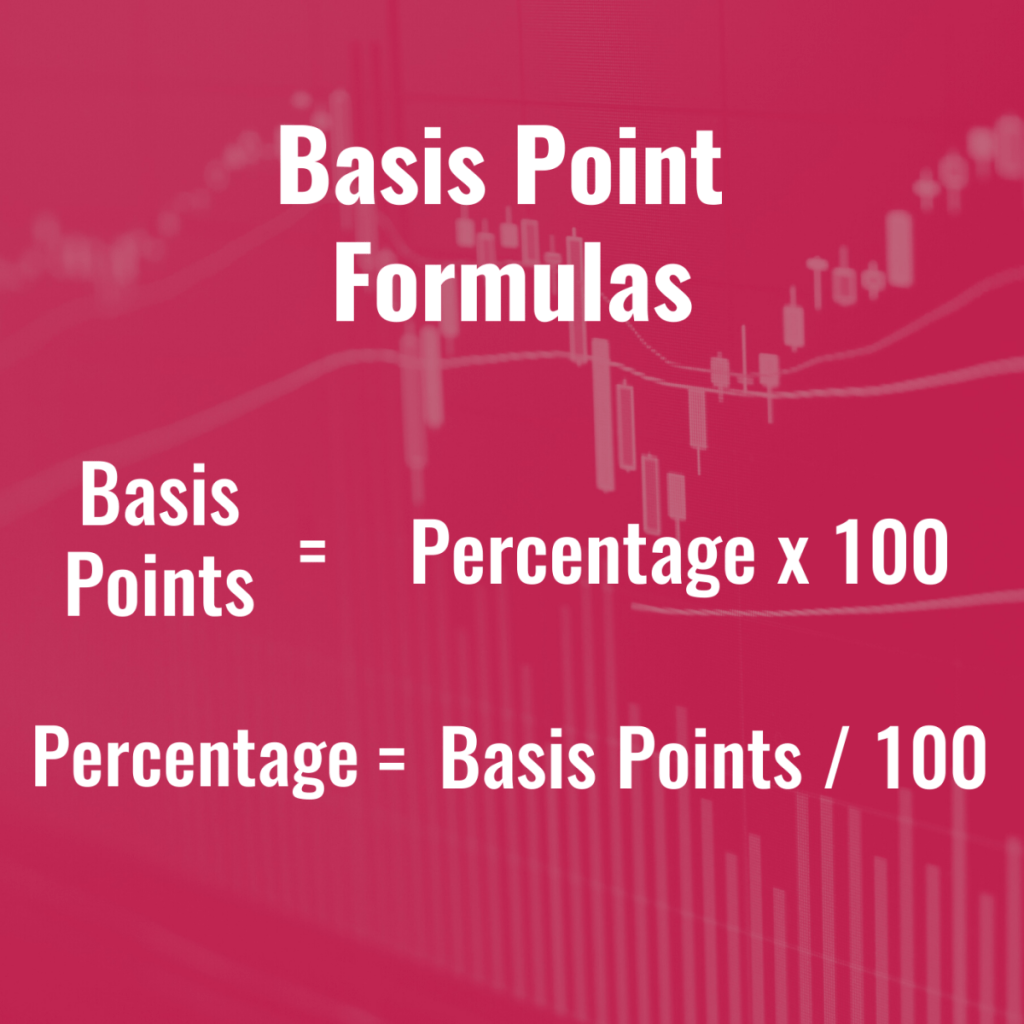

Basis Points are used in financial literature to express values that are carried out to two decimal places (hundredths of a percentage point), particularly ratios, such as yields, fees, and returns. Basis points describe values that are typically on the right side of the decimal point–one basis point equals one one-hundredth of a percentage point (0.01%). So 25 basis points equals 0.25%, and 50 basis points equals 0.50%.

Only when basis points equal or exceed 100 does the value move to the left of the decimal point–100 basis points equals 1.00%, 500 basis points equals 5.00%, etc.

CITE: https://www.r2library.com/Resource/Title/0826102549

Bid/Ask Spread (also known as bid/offer spread) is the difference between the National Best Bid and the National Best Offer, which represents the implied cost to trade a security.

As compensation for the risk taken, the market maker (or dealer) earns the bid/offer spread in exchange for facilitating the trade. Wider spreads generally indicate higher costs associated with trading the underlying assets in the ETF, hedging costs, inventory management costs, and general market risk.

CITE: https://www.r2library.com/Resource/Title/0826102549

COMMENTS APPRECIATED

Thank You

Please Subscribe

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, iMBA, iMBA, Inc., Investing, Marcinko Associates, Touring with Marcinko | Tagged: basis point, basis points, bid/ask spread, bid/offer spread, economy, ETF, finance, iMBA, Institute Medical Business Advisors, Investing, Marcinko, Medical Business Advisors Inc, real-estate, stocks |

Leave a comment