New Reporting Warning Issued

By Staff Reporters

***

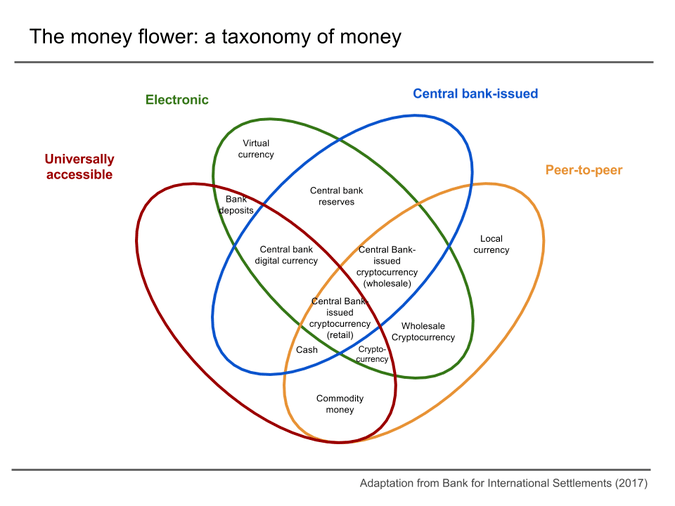

Virtual currency transactions are taxable by law just like transactions in any other property. Taxpayers transacting in virtual currency may have to report those transactions on their tax returns.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

***

All taxpayers must answer a question about virtual currency on their return.

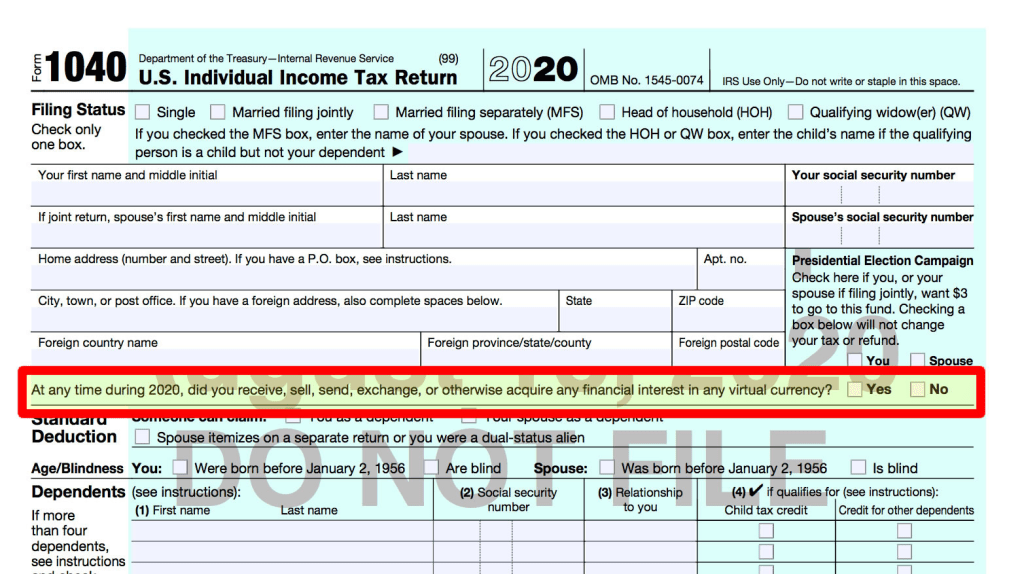

On March 18th, the IRS issued a new alert warning all taxpayers that they must answer a section about virtual currency on their 2021 tax refund this year, even if they did not deal with any digital transactions. According to the agency, there is a question on the top of all versions of Form 1040 that asks, “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

“All taxpayers filing Form 1040, Form 1040-SR or Form 1040-NR must check one box answering either ‘Yes’ or ‘No’ to the virtual currency question,” the IRS explained. “The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency in 2021.”

IRS: https://www.irs.gov/businesses/small-businesses-self-employed/virtual-currencies

***

COMMENTS APPRECIATED

Thank You

Subscribe to the Medical Executive-Post

***

****

Filed under: Accounting, Investing, Taxation | Tagged: digital currency, digital currency taxation, IRS, IRS digital currency, taxation digital currency, virtual currency, virtual currency taxation | Leave a comment »