By Related Influential Thought-Leaders

- Dr. Brad Klontz CSAC CFP®

- Dr. Ted Klontz PsyD

- Dr. Eugene Schmuckler MBA MEd CTS

- Dr. Kenneth Shubin-Stein FACP CFA

- Dr. David Edward Marcinko MEd MBA CMP™

***

***

James O. Prochaska PhD, Professor of Psychology and Director of the Cancer Prevention Research Center at the University of Rhode Island, developed the Trans-Theoretic Model of Behavior Change [TTM] which has been evolving since in 1977. Nominated as one of the five most influential authors in Psychology, by the Institute for Scientific Information and the American Psychological Society, Dr. Prochaska is author of more than 300 papers on behavior change for health promotion and disease prevention.

TTM Stages of Change

In his Trans-Theoretical Model, behavior change is a “process involving progress through a series of these stages:

- Pre-Contemplation (Not Ready) – “People are not intending to take action in the foreseeable future, and can be unaware that their behavior is problematic”

- Contemplation (Getting Ready) – “People are beginning to recognize that their behavior is problematic, and start to look at the pros and cons of their continued actions”

- Preparation (Ready) – “People are intending to take action in the immediate future, and may begin taking small steps toward behavior change”

- Action – “People have made specific overt modifications in changing their problem behavior or in acquiring new healthy behaviors”

- Maintenance – “People have been able to sustain action for a while and are working to prevent relapse”

- Termination – “Individuals have zero temptation and they are sure they will not return to their old unhealthy habit as a way of coping”

Relapse

In addition, researchers conceptualized “relapse” (recycling) which is not a stage in itself but rather the “return from Action or Maintenance to an earlier stage.” In medical care, these stages of behavior change have applicability to anti-hypertension and lipid lowering medication use, as well as depression prevention, weight control and smoking cessation.

***

***

Uniting Psychology and Financial Behavior

More recently, validating the emerging alliance between psychology (human behavior) and finance (economics) are two Americans who won the Royal Swedish Academy of Science’s 2002 Nobel Memorial Prize in Economic Science. Their research was nothing short of an explanation for the idiosyncrasies incumbent in human financial decision-making outcomes.

Enter Kahneman and Smith

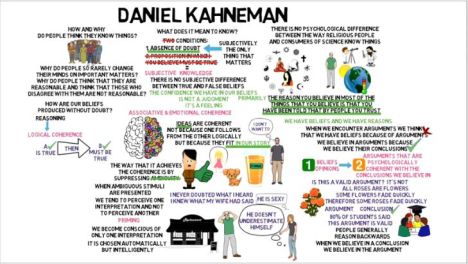

Daniel Kahneman, PhD, professor of psychology at Princeton University, and Vernon L. Smith, PhD, professor of economics at George Mason University in Fairfax, Va., shared the prize for work that provided insight on everything from stock market bubbles, to regulating utilities, and countless other economic activities. In several cases, the winners tried to explain apparent financial paradoxes.

For example, Professor Kahneman made the economically puzzling discovery that most of his subjects would make a 20-minute trip to buy a calculator for $10 instead of $15, but would not make the same trip to buy a jacket for $120 instead of $125, saving the same $5.

in vitro and in-vivo Economics

Initially, in the 1960’s, Smith set out to demonstrate how economic theory worked in the laboratory (in vitro), while Kahneman was more interested in the ways economic theory mis-predicted people in real-life (in-vivo). He tested the limits of standard economic choice theory in predicting the actions of real people, and his work formalized laboratory techniques for studying economic decision making, with a focus on trading and bargaining.

Later, Smith and Kahneman together were among the first economists to make experimental data a cornerstone of academic output. Their studies included people playing games of cooperation and trust, and simulating different types of markets in a laboratory setting. Their theories assumed that individuals make decisions systematically, based on preferences and available information, in a way that changes little over time, or in different contexts.

University of Chicago

By the late 1970’s, Richard H. Thaler, PhD, an economist at the University of Chicago also began to perform behavioral experiments further suggesting irrational wrinkles in standard financial theory and behavior, enhancing the still embryonic but increasingly popular theories of Kahneman and Smith.

Other economists’ laboratory experiments used ideas about competitive interactions pioneered by game theorists like John Forbes Nash Jr., PhD, who shared the Nobel in 1994, as points of reference.

Assessment

But, Kahneman and Smith often concentrated on cases where people’s actions departed from the systematic, rational strategies that Nash envisioned. Psychologically, this was all a precursor to the informal concept of life or holistic financial planning. Kahneman was awarded the Medal of Freedom, by President Barack Obama, on November 20, 2013.

READ: Behavioral Economics and Psychology DEM

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

Invite Dr. Marcinko

***

Filed under: Ethics, Investing, LifeStyle, mental health, Risk Management, Touring with Marcinko | Tagged: behavioral economics, behavioral finance, Brad Klontz, CMP™ Course, Daniel Kahneman, david marcinko, Dr. Ted Klontz, Eugene Schmuckler, James O. Prochaska, John Forbes Nash Jr, Kenneth Shubin-Stein, Richard H. Thaler, Vernon L. Smith | 4 Comments »