By Staff Reporters

***

***

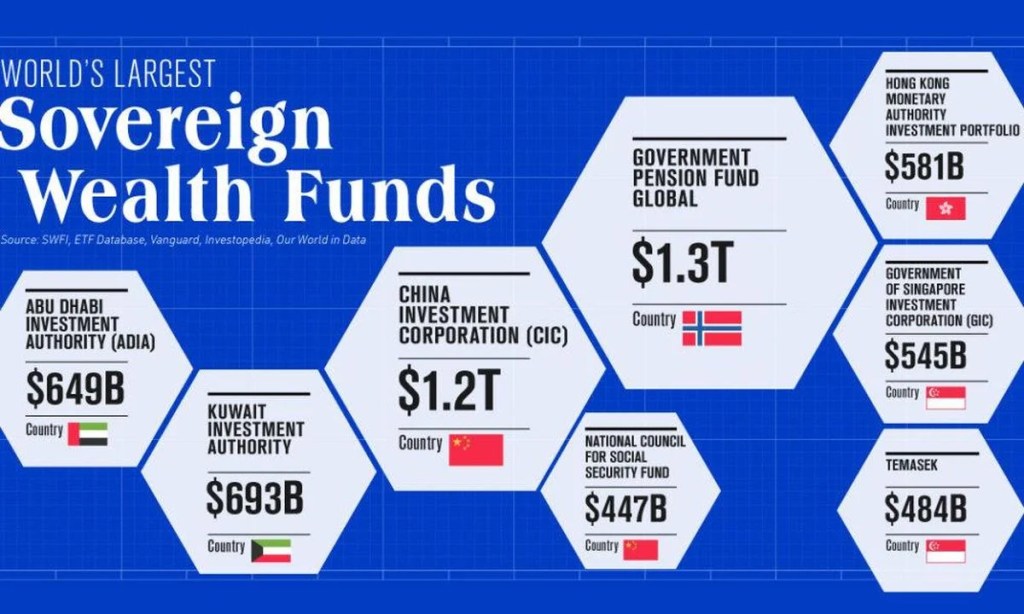

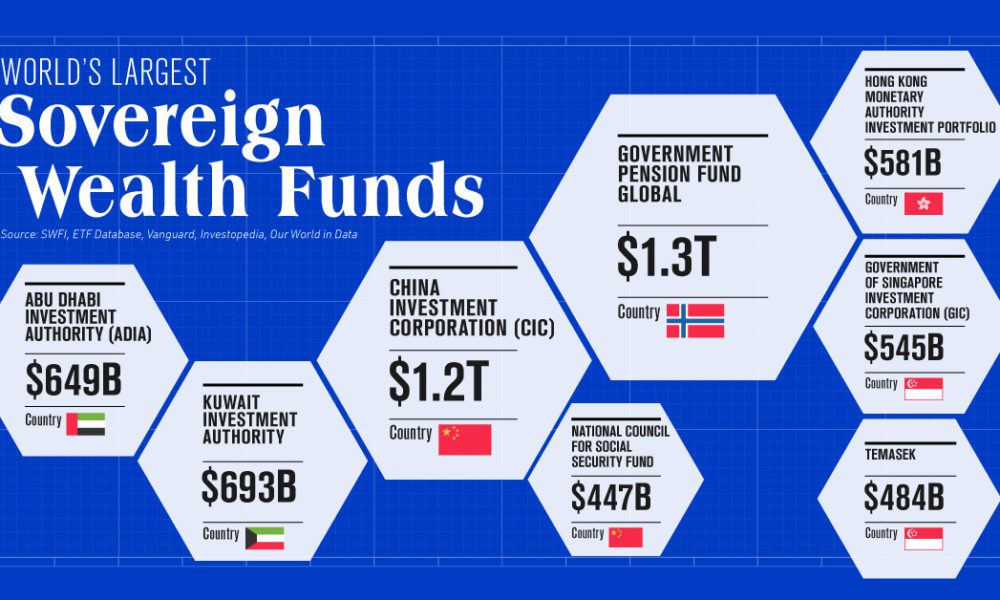

A SWF is essentially an investment fund run by the government. Similar to how a hedge fund or a private equity firm operates, the government would set aside a pot of money and invest it in assets such as stocks, bonds, startups, or real estate.

The idea of the US establishing a sovereign wealth fund akin to Norway’s or Abu Dhabi’s gained momentum recently across the political spectrum. Former President Trump endorsed the concept during a speech on his economic policy agenda for a second term, and the Biden administration has been quietly cheffing up a proposal for a wealth fund over the past several months, Bloomberg reported.

Trump and Biden officials described the fund as a key tool the country could deploy to win the global technological arms race and better compete against geopolitical rivals like China.

For example, the wealth fund could finance capital-intensive sectors such as shipbuilding, nuclear fission, and quantum cryptography that don’t offer near-term ROI for private investors.

However, disadvantages of a SWF include:

- Non-Guaranteed Returns, with the Risk of Total Loss

- Influence on Foreign Exchange Rates, Introducing Uncertainty

- Potential Mismanagement of Funds Due to a Lack of Transparency

- Dependency on Global Economic Conditions, Impacting Fund Performance

- Challenges in Maintaining Accountability and Addressing Ethical Concerns

SUBSCRIBE TODAY

Thank You

***

***

Filed under: "Ask-an-Advisor", Accounting, Funding Basics, Glossary Terms, Investing | Tagged: Bloomberg, hedge fund, Private Equity, SOVEREIGN WEALTH FUND: Defined, SWF | Leave a comment »