By dcpalter

***

***

What is an SPV and When Do You Need One?

***

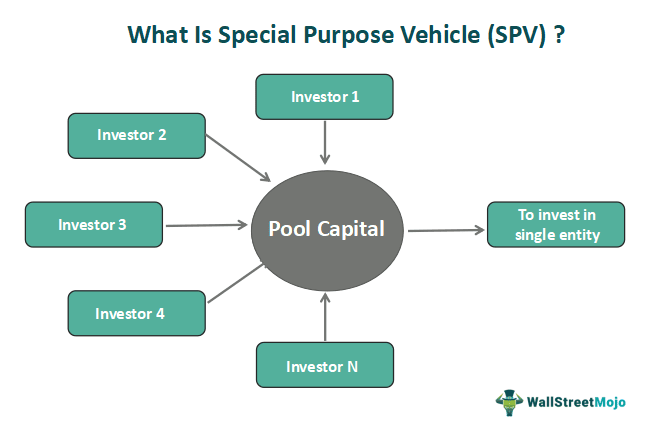

A special purpose vehicle (SPV), or a special purpose entity (SPE), is a legal entity that a parent company creates to hold separate assets from the parent’s balance sheet. Its purpose is to isolate the parent company from any potential credit or financial risk that may arise from the SPV and is often used to pursue riskier projects, securitize debt, or transfer assets. Since an SPV is separate from the parent company, it isn’t affected by the parent’s performance, and the parent isn’t typically affected by the performance of the SPV. If the parent goes bankrupt and is no longer in existence, the SPV can carry on. This makes an SPV bankruptcy remote. This also means that the parent company is unaffected by the loss if the SPV fails. MORE: https://www.wallstreetoasis.com/resources/skills/strategy/special-purpose-vehicle-spv Related: https://medicalexecutivepost.com/2024/07/26/spac-v-direct-listing-v-ipo/ |

COMMENTS APPRECIATED

Refer and Like

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: business, entrepreneurship, finance, fund raising, IPO, SPAC, special purpose acquisition companies, special purpose vehicle, SPV, startups, Venture Capital | Leave a comment »