SHORT SALE

By Staff Reporters

***

***

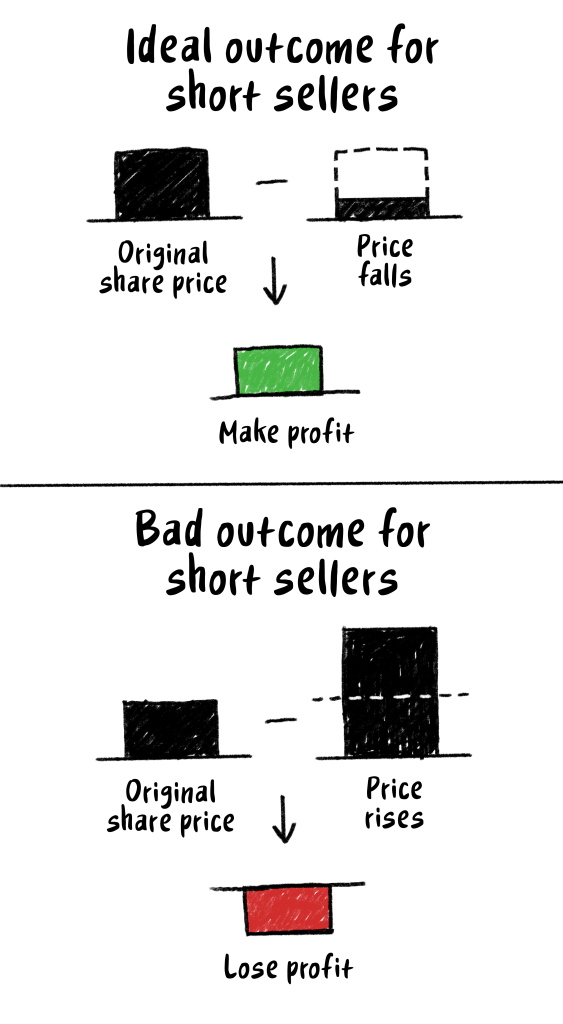

DEFINITION: Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later, hopefully for a lower price than you initially sold it for, and pocket the difference after repaying the initial loan.

CITE: https://www.r2library.com/Resource/Title/082610254

***

Good news for anyone who was busy shorting Tesla

Tesla’s stock plummeted more than 12% yesterday for its worst trading session in more than two years. The proximate cause: Though the EV manufacturer sent out a record 405,278 vehicles in the last quarter of 2022, it missed analyst expectations and its own growth goal for the year.

Tesla’s brutal selloff was the continuation of a dramatic downward trend: The most valuable automaker in the world lost 65% of its value in 2022.

And while it may be easy to pin the blame on CEO Elon Musk’s fascination with his shiny new toy, Twitter, the problems go beyond a distracted boss:

- Production has slowed down due to Covid shutdowns in China.

- Demand has cooled for its vehicles due to lower gas prices, interest rate hikes, and increased competition.

- It has suffered from logistical issues that were at least partially to blame for its inability to deliver all of the vehicles that it produced.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Advisors Only", Accounting, Breaking News, Funding Basics, Investing, Risk Management | Tagged: short, Short Selling, SHORT: Tesla Stock?, shorts, Tesla | 1 Comment »