THE ESSENTIAL DOCUMENT

By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.MarcinkoAssociates.com

***

***

In order to create and monitor an investment portfolio for personal or institutional use, the physician executive, financial advisor, wealth manager, or healthcare institutional endowment fund manager, should ask three questions:

- How much do we have invested?

- How much did we make on our investments?

- How much risk did we take to get that rate of return?

Introduction to the IPS

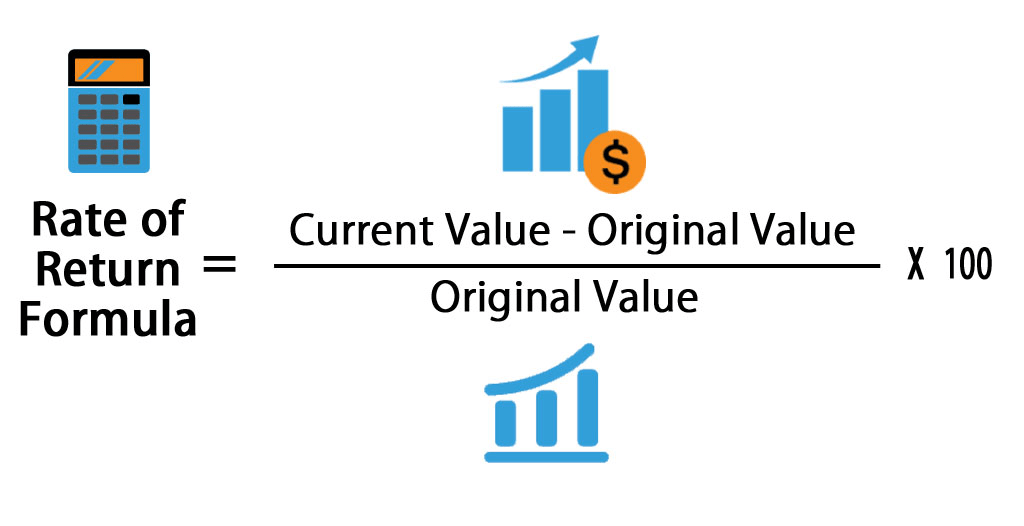

Most doctors, and hospital endowment fund executives, know how much money they have invested. If they don’t, they can add a few statements together to obtain a total. But, few can answers the questions above or actually know the rate of return achieved last year; or so far this year. Everyone can get this number by simply subtracting the ending balance from the beginning balance and dividing the difference. But, few take the time to do it. Why? A typical response to the question is, “We’re doing fine.”

POOR DOCTORS: https://medicalexecutivepost.com/2025/07/29/why-too-many-physician-colleagues-dont-get-rich/

Now, ask how much risk is in the portfolio and help is needed [risk adjusted rate of return]. In fact, Nobel laureate Harry Markowitz, Ph.D. said, “If you take more risk, you deserve more return.” Using standard deviation, he referred to the “variability of returns;” in other words, how much the portfolio goes up and down, its volatility [Markowitz, H: Portfolio Selection. Journal of Finance, March, 1952].

***

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Ask a Doctor, business, Experts Invited, Glossary Terms, Investing, Marcinko Associates, Portfolio Management, Touring with Marcinko | Tagged: finance, Investing, investment, Investment Advice, Investment Policy Statement, IPS, journal finance, Marcinko, Markowitz, personal-finance, portfolio, RARR, rate return, risk, stocks | Leave a comment »