By Staff Reporters

***

***

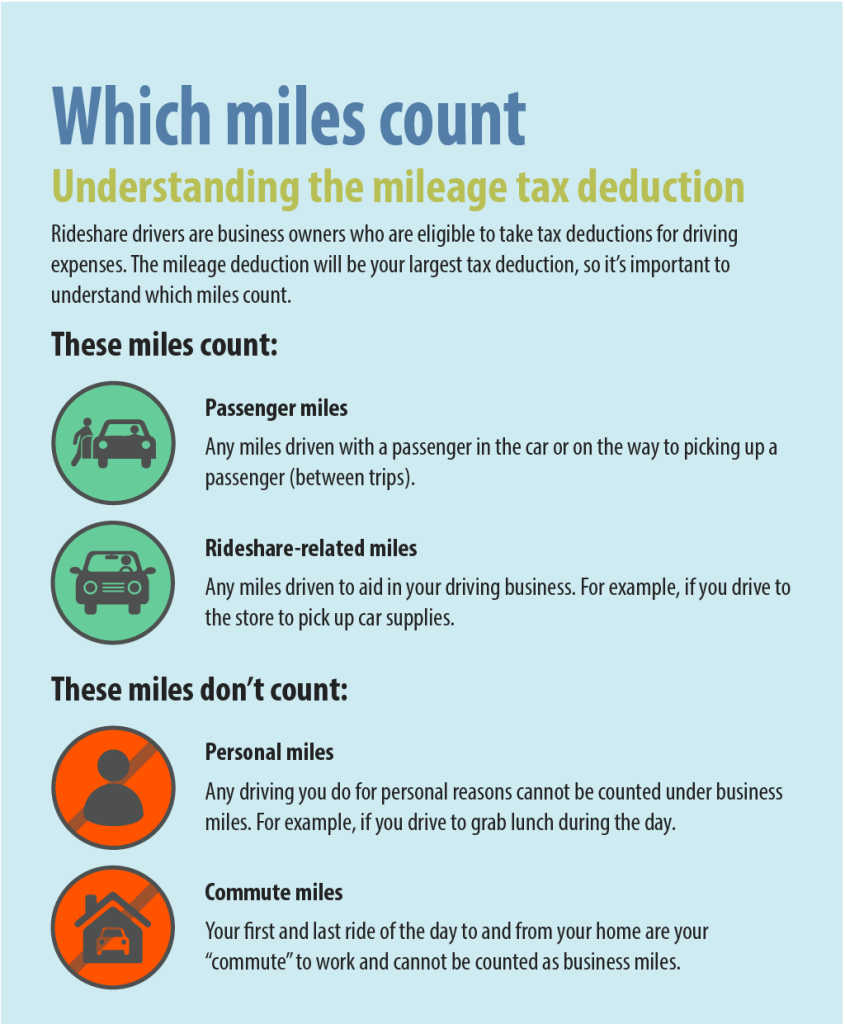

The federal tax deduction that businesses and self-employed taxpayers can use for their work-related miles on the road is suddenly getting more generous. The optional standard mileage rate for business-related driving is increasing to 62.5 cents a mile, starting in July, the Internal Revenue Service announced Thursday. That’s up from the 58.5-cents-a-mile rate first announced in December.

Rising inflation continues to frustrate consumers who are growing tired of shelling out more money. for example, Record gas prices helped push down the consumer sentiment index from 58.4 in May to 50.2 in June – the lowest recorded level since November 1952. The preliminary reading is comparable to the trough reached during the 1980 recession, according to Joanne Hsu, director of the university’s Surveys of Consumers. In May 1980, the sentiment reading hit 51.7, according to historical data. The final reading for June will be published on June 24th.

- Markets: The S&P 500 is on the bear market watch list after a vicious sell-off yesterday capping off its worst week since January. Investors were disappointed by the inflation report that dropped Friday. Prices jumped 8.6% last month, which is a faster pace than in April and higher than expected. Rents, food, energy, and used cars all contributed to the price increases, putting even more pressure on the Fed to hike interest rates substantially throughout the summer and into the fall.

***

COMMENTS APPRECIATED

Thank You

***

***

***

Filed under: Accounting, Alerts Sign-Up, Investing, LifeStyle, Taxation | Tagged: consumer sentiment, inflation, IRS, IRS mileage deduction, mileage deduction, mileage deductions | Leave a comment »