By Staff Reporters

***

***

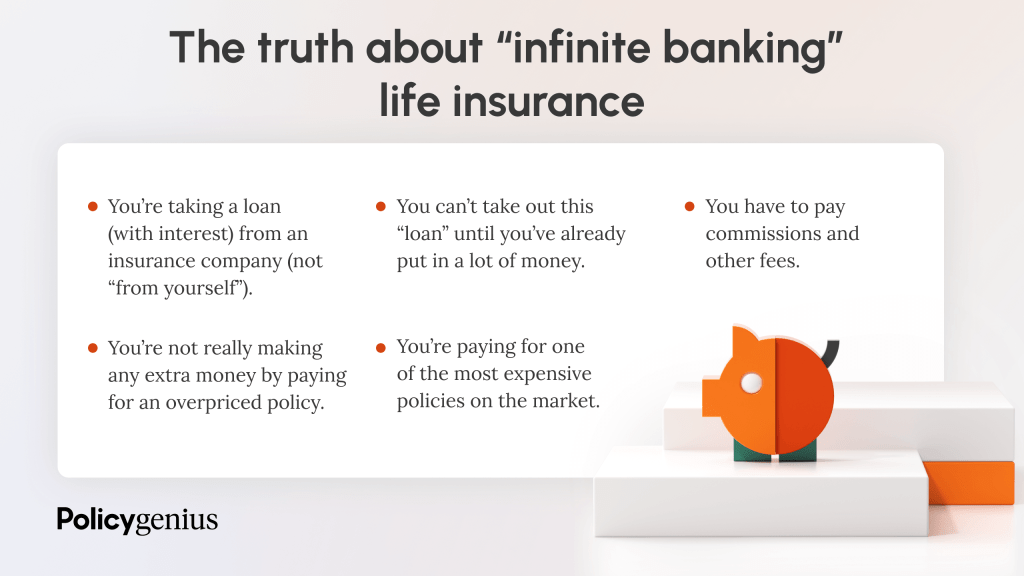

Infinite banking is not a product or service offered by a specific institution. It’s a concept promoted as a way you can “be your own bank” to have more control over your money.

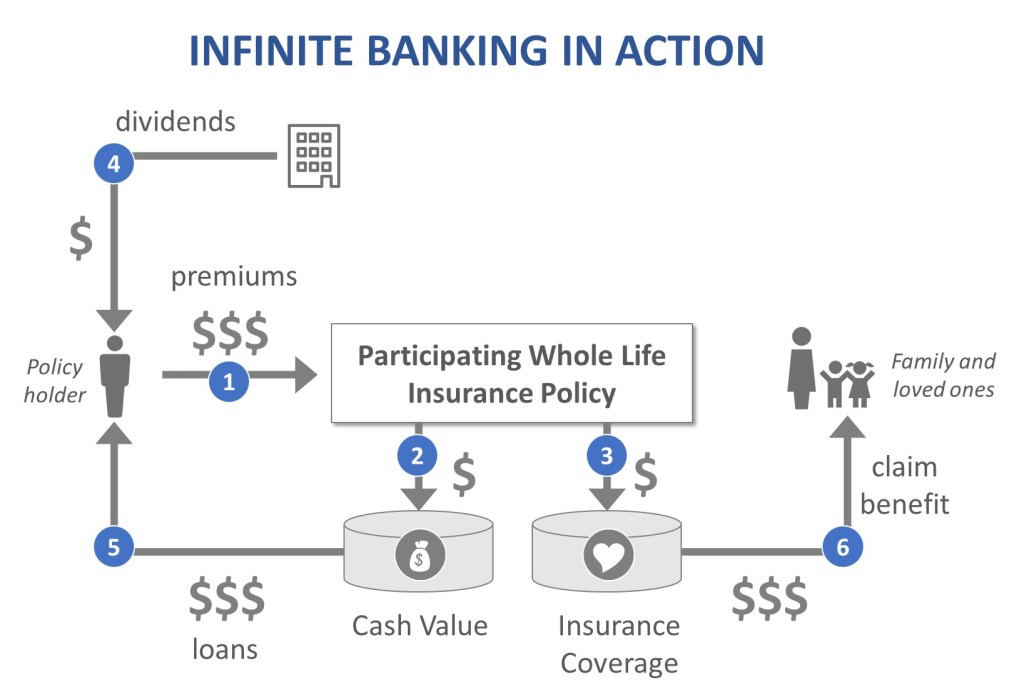

Infinite banking is a strategy in which you buy a life insurance policy that accumulates interest-earning cash value and take out loans against it, “borrowing from yourself” as a source of capital. Then eventually pay back the loan and start the cycle all over again. To whit:

- Buy a cash value life insurance policy, which you own and control.

- Pay policy premiums, a portion of which builds cash value.

- Cash value earns compounding interest.

- Take a loan out against the policy’s cash value, tax-free.

- Repay loans with interest.

- Cash value accumulates again, and the cycle repeats.

If you use this concept as intended, you’re taking money out of your life insurance policy to purchase everything you’d need for the rest of your life. Cars. Houses. Airplane tickets. Netflix.

So, when you pay back the policy loan, just as you’d have to pay back any mortgage, auto loan, or credit card, you’re paying yourself back.

Nelson Nash popularized this concept in his book Becoming Your Own Banker.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: Book Reviews, Experts Invited, Funding Basics, Glossary Terms, Insurance Matters, LifeStyle | Tagged: banking, Becoming Your Own Banker, books, infinite banking, insurance agent, life insurance, loan, Nelson Nash, policy genius, policygenius | Leave a comment »