HOW DO THEY WORK?

By Staff Reporters

***

***

What is an I bond and how do they work?

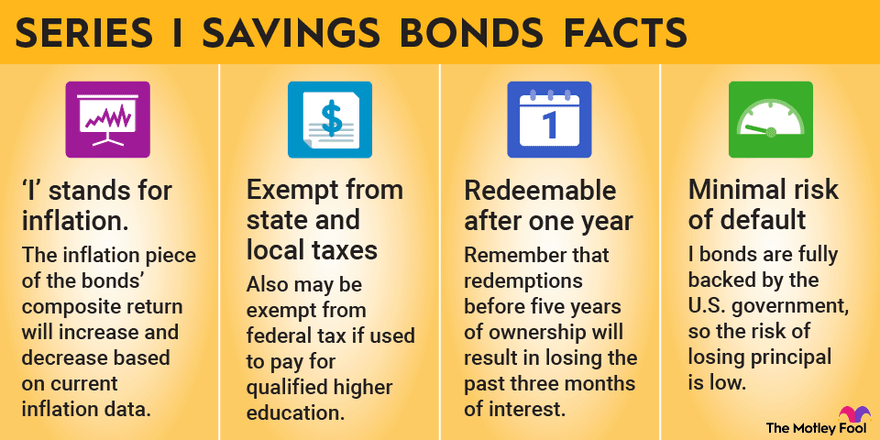

DEFINITION: A a 30-year Treasury bond that protects you against inflation. It pays both a fixed interest rate and a rate that changes twice a year with inflation.

Interest is compounded semiannually, meaning every 6 months a new interest rate is applied to a new principal value that equals the prior principal plus the interest earned in the last 6 months. The bond’s value grows because it earns interest and because the principal value gets bigger.

You can buy $10,000 worth from the Treasury and another $5,000 using your tax refund. You can cash them in after 12 months, but if you do so in less than 5 years, you lose the last 3 months of interest.

Taxes on I Bonds?

You must pay federal income tax but no state and local taxes on I bonds. You can either report each year’s earnings or wait to report all the earnings when you cash the bond.

If you use the money for qualified higher education expenses, you may not owe tax on the earnings.

Current Interest Rates

The current the record high 9.62% interest rate on I bonds issued through October will drop Nov. 1st, 2022 to 6.48%.

***

CONTRARY OPINION: https://www.msn.com/en-us/money/markets/why-i-don-t-want-i-bonds/ar-AA13uyWg?cvid=ee66997c39214055ab89f3883629bb92

***

ORDER: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

COMMENTS APPRECIATED

Thank You

****

Filed under: iMBA, Inc., Investing | Tagged: bonds, I bonds, inflation bonds, Treasury, US Treasury "I" Bonds [Maybe -OR- Not?] | Leave a comment »