MUCH MORE COMPLICATED THAN MOST [PHYSICIAN] INVESTORS THINK!

***

By Dr. David Edward Marcinko MBA CMP®

SPONSORED: http://www.CertifiedMedicalPlanner.org

REAL LIFE EXAMPLE: May 11, 2021

| Dow | 34,269.16 | -473.66 | -1.36% | ||

| S&P 500 | 4,152.10 | -36.33 | -0.87% | ||

| Nasdaq | 13,389.43 | -12.43 | -0.09% | ||

| GlobalDow | 4,011.09 | -61.07 | -1.50% |

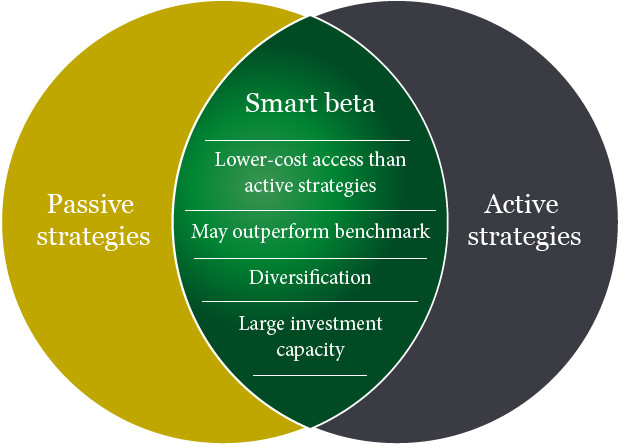

Most all investors and physician executives are aware of the concept of financial beta.

BETA: A Systemic risk measurement benchmark correlating with a change in a specific index.

EXAMPLE: The measure of a stock’s volatility relative to the market, where a beta lower than 1 means the stock is less sensitive than the market as a whole; higher than 1 indicates the stock is more volatile than the market. The healthcare industry is considered to be increasingly volatile and hence possess a higher beta.

CITATION: https://www.r2library.com/Resource/Title/0826102549

QUERY: But, what about more granular concepts like Levered Beta vs Un-levered Beta?

LINK: https://corporatefinanceinstitute.com/resources/knowledge/valuation/what-is-beta-guide/

ALPHA versus BETA Podcast: https://youtu.be/dP_23vKJ3HQ

YOUR THOUGHTS ARE APPRECIATED

SECOND OPINIONS: https://medicalexecutivepost.com/schedule-a-consultation/

INVITE DR. MARCINKO: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

THANK YOU

***

Filed under: Investing, Touring with Marcinko | Tagged: Certified Medical Planner™, David Edward Marcinko, Financial Beta, Levered Beta, systemic risk, Un-levered Beta | 3 Comments »