A TERM ALL PHYSICIAN INVESTORS MUST KNOW

SPONSOR: http://www.CertifiedMedicalPlanner.org

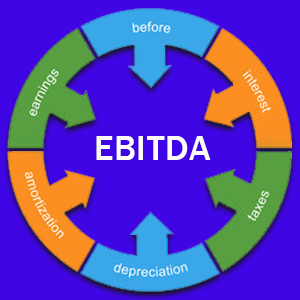

What Is Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)?

***

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company’s overall financial performance and is used as an alternative to net income in some circumstances. EBITDA, however, can be misleading because it strips out the cost of capital investments like property, plant, and equipment.

This metric also excludes expenses associated with debt by adding back interest expense and taxes to earnings. Nonetheless, it is a more precise measure of corporate performance since it is able to show earnings before the influence of accounting and financial deductions.

Simply put, EBITDA is a measure of profitability. While there is no legal requirement for companies to disclose their EBITDA, according to the U.S. generally accepted accounting principles (GAAP), it can be worked out and reported using the information found in a company’s financial statements.

The earnings, tax, and interest figures are found on the income statement, while the depreciation and amortization figures are normally found in the notes to operating profit or on the cash flow statement. The usual shortcut to calculate EBITDA is to start with operating profit, also called earnings before interest and tax (EBIT) then add back depreciation and amortization.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

MORE: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

YOUR COMMENTS ARE APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", "Doctors Only", Accounting, CMP Program, Glossary Terms, Investing | Tagged: and Amortization, Certified Medical Planner™, CMP, Depreciation, Earnings Before Interest, EBITDA, taxes | Leave a comment »