DEFINITION

“Show Me the Money”

By Staff Reporters

***

***

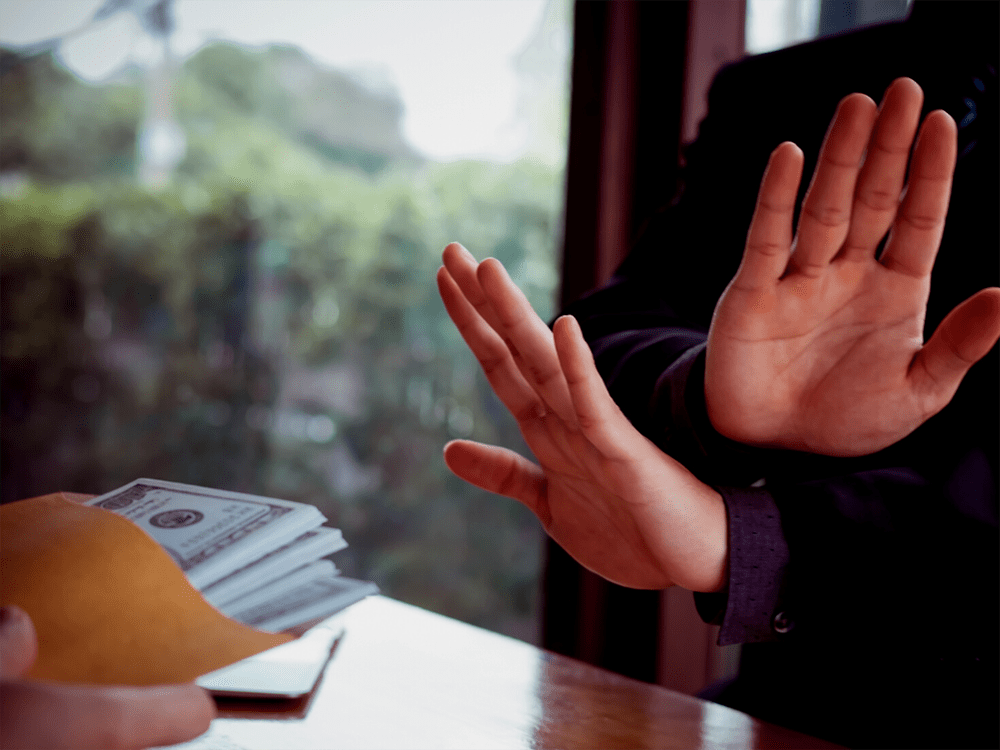

In some situations, an inheritance might complicate an estate and add to the estate tax burden. If there are sufficient assets and income to accomplish financial goals, more assets are not needed. A disclaimer may be useful. This is an unqualified refusal to accept a gift or inheritance, that is, when you “just say no”. You have decided not to accept a sizable gift made under a will, trust or other document.

When you disclaim the property, certain requirements must be met:

- The disclaimer must be irrevocable;

- The refusal must be in writing;

- The refusal must be received within nine months;

- You must not have accepted any interest in the property; and

- As a result of the refusal, the property will pass to someone else.

The property passes under the terms of the decedents will, as if you had predeceased the decedent. If the filer of the disclaimer has control, the property will be included in the disclaimant’s estate and can only be passed to another as a gift for as an inheritance. The intent of the disclaimer is to renounce and never take control of the property.

COMMENTS APPRECIATED

Refer, Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Book Reviews, Estate Planning, Ethics, Glossary Terms, Risk Management, Taxation | Tagged: Accounting, books, CPA, disclaimer, Estate Planning, inheritance, inheritance disclaimer, JD, Marcinko, tax, trusts, will | Leave a comment »