By Staff Reporters

***

***

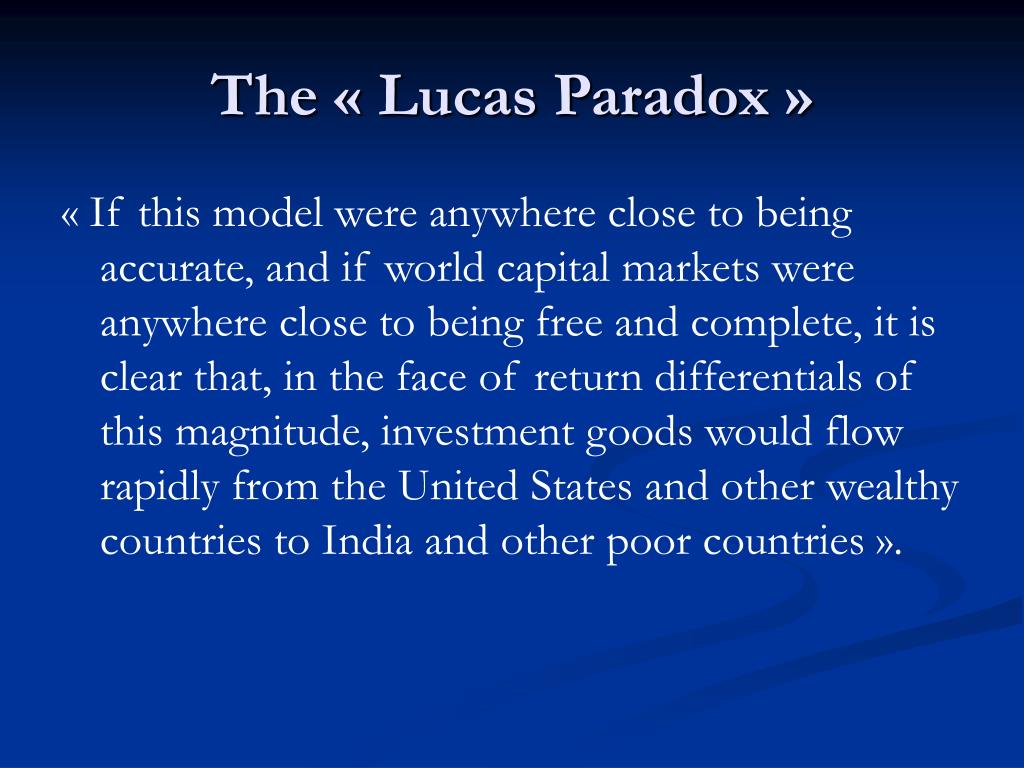

The Lucas Paradox occurs when capital is not flowing from developed countries to developing countries despite the fact that developing countries have lower levels of capital per worker, and therefore higher returns to capital.

According to Wikipedia, economic theory predicts that capital should flow from rich countries to poor countries, due to the effect of diminishing returns of capital. Poor countries have lower levels of capital per worker – which explains, in part, why they are poor. In poor countries, the scarcity of capital relative to labor should mean that the returns related to the infusion of capital are higher than in developed countries.

In response, savers in rich countries should look at poor countries as profitable places in which to invest. In reality, things do not seem to work that way. Surprisingly little capital flows from rich countries to poor countries. This puzzle was famously discussed in a paper by Robert Lucas PhD in 1990.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: developed countries, developing countries, economic, economics, economy, finance, Lucas paradox, paradox, Robert Lucas, wikipedia | Leave a comment »