By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Currency Hedging is a risk-management strategy, as part of a foreign investment strategy, currency hedging is designed to reduce the impact from changes in the relative values of currencies involved in the foreign investment strategy.

CITE: https://www.r2library.com/Resource/Title/0826102549

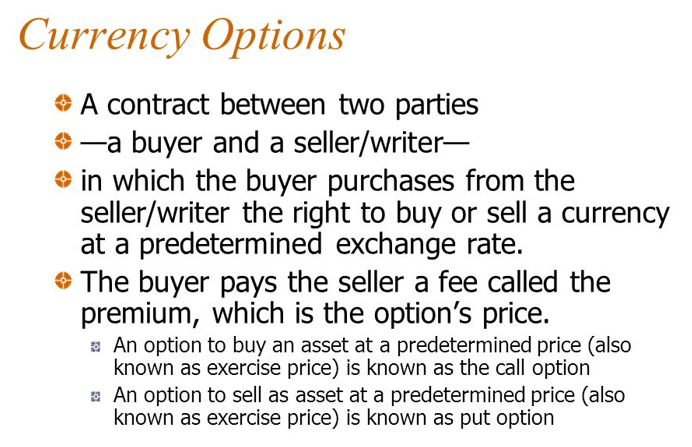

In any foreign investment strategy, a significant part of the potential risk and return comes from exposure to relative currency value fluctuations. If exposure to those currency fluctuations is minimized, investors can experience more of a “pure play” exposure to the foreign investments. There is a variety of possible currency hedging strategies, ranging from swaps, options, and spot contracts to simply buying foreign currencies.

Currency Overlay is a financial trading strategy used to separate the management of currency risk from other portfolio strategies. A currency overlay manager can seek to hedge the risk from adverse movements in exchange rates, and/or attempt to profit from tactical currency views.

CITE: https://www.r2library.com/Resource/Title/0826102549

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Funding Basics, Glossary Terms, iMBA, Inc., Investing, Touring with Marcinko | Tagged: currency buyer, currency contracts, currency exchange rate, currency hedging, currency options, currency overlay, currency seller, economy, finance, Forex, iMBA, Investing, Marcinko, trading | Leave a comment »