By A.I. and Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

After a lifetime of hard work practicing medicine and saving, you’re at the retirement finish line. Instead of a paycheck, you’re relying on your nest egg and investment income to cover the bills. Picking the right investments is even more important, as you won’t have much chance to recover as a retired MD, DO, DPM or DDS.

“You made it to the top of the mountain through a systematic approach and are trying to make your way down safely,” says retirement planner John Gillet John Gillet in Hollywood, Fla. “Why throw all caution to the wind and try something different now?”

***

***

Definitions

An annuity is an insurance contract designed to grow your money and then repay it as income. There are different versions. An immediate annuity turns your lump sum into future guaranteed income payments, like your own personal pension. They are simple to understand with no or small fees.

Fixed annuities pay a guaranteed interest rate over a set period to grow your money, like 5% a year for five years. These options could make sense as part of a retirement plan.

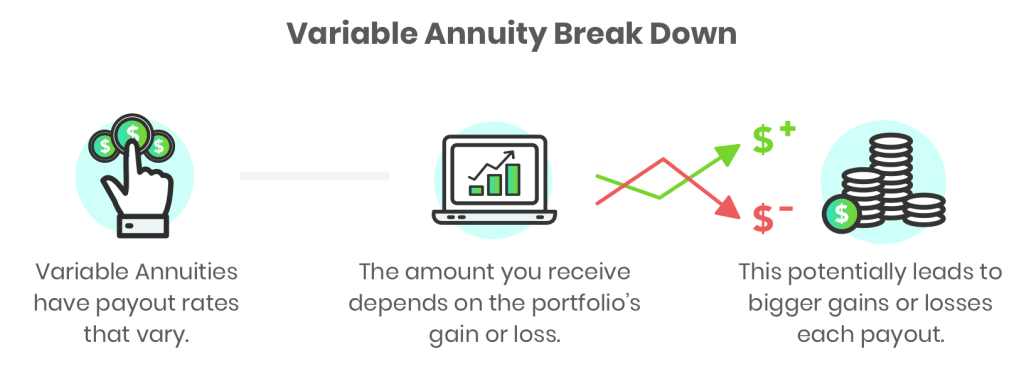

A variable annuity, on the other hand, invests your savings in mutual funds. While you can buy riders that guarantee a minimum income, you’ll be paying very much for it. “All in, the annual fees can be 3% or more of your balance,” says Jeff Bailey, an advisor from Nashville. “That’s a huge withdrawal rate from your portfolio versus investing on your own.”

The variable annuity will lock up your money for years. If you cancel early, you owe a surrender charge that could start at 7% or more of your annuity balance before gradually going down as time goes by. “Clients believe they can walk away with their contract value, but that’s often not true,” says Bailey.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", CMP Program, Ethics, Experts Invited, Funding Basics, Glossary Terms, Insurance Matters, Investing, Marcinko Associates, Portfolio Management | Tagged: annuities, beware annuities, beware physicians, CMP, david marcinko, DDS, DO, finance, fixed annuities, Gillet John, Jeff Bailey, MD, Mutual Funds, retired doctors, retired physicians, retirement, retirement planning, variable annuities |

Leave a comment