By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

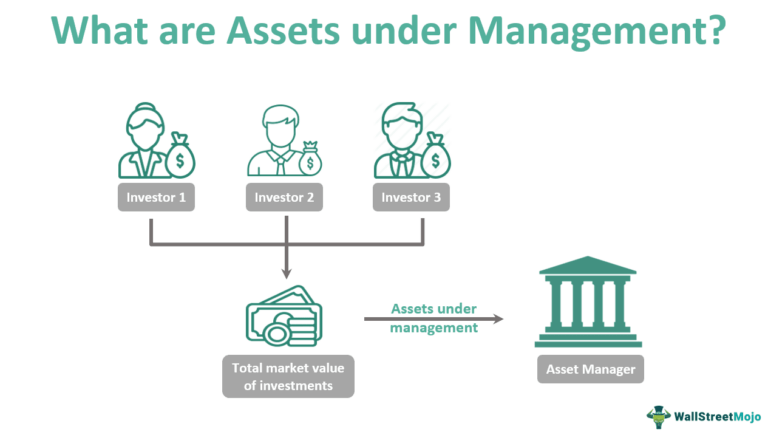

What are Assets Under Management?

Assets under management (AUM) is a significant parameter in the financial world. It answers financial questions like – how many investments does a company manage? What is the net value of the investments that the company manages? Finally, how many investors have trusted their assets with the company? The higher the answer to these three questions, the more glory to the company.

A wealthy investor who is not concerned by higher fees but wants maximum returns of their asset will probably choose an asset manager based on its AUM. Thus, the AUM indicates the financial performance of the firm. Also, based on the funds under management, the firm collects fees from other clients.

So, what are the investments which qualify as AUM? Any liquid asset of the investor they have entrusted the asset manager with monitoring and control. For example, bank deposits, cash balances, equity shares, bonds, mutual funds, and other investments.

What are the services an asset manager provides to their clients? The most important function is decision-making. With the constant fluctuations and rapid movements in the market, an asset manager has to make decisions about holding or selling an investment. The firm communicates with the investors and advises them about the necessary action.

Once the decision is taken, the firm acts on the decision, i.e., the investor does not have to enter the field. In addition, the asset management company will buy, sell, and make any other transactions on behalf of the investor. Finally, the firm also renders services like accounting, tax reporting, proxy voting (equity shares), client reporting, and other financial services.

What are Assets Under Advisement?

Assets under advisement refer to assets on which your firm provides advice or consultation but for which your firm does either does not have discretionary authority or does not arrange or effectuate the transaction. Such services would include financial planning or other consulting services where the assets are used for the informational purpose of gaining a full perspective of the client’s financial situation, but you are not actually placing the trade.

Assets under advisement could also be those which you monitor for a client on a non-discretionary basis, where you may make recommendations but where the client is the party responsible for arranging or effecting the purchase or sale. A common example of this scenario is when an adviser reviews a participant’s 401(k) allocations. If the adviser does not have the authority or ability to effect changes in the portfolio, these assets are likely considered assets under advisement rather than regulatory assets under management.

Assets under advisement are permitted to be disclosed on Form ADV Part 2A as a separate asset figure from the assets under management. There is no requirement to disclose the assets under advisement figure, but some advisers opt to include the figure to give prospective clients a more complete picture of the firm’s responsibilities. If you choose to report your assets under advisement, be sure to make a clear distinction between this figure and your regulatory assets under management.

NOTE: Essay with thanks to Chat GPT.

COMMENTS APPRECIATED

Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Portfolio Management, Taxation, Touring with Marcinko | Tagged: advisement, asset management company, assets, assets advisement, assets management, business, ChatGPT, finance, Investing, Management, Marcinko |

Leave a comment