By Staff Reporters

***

***

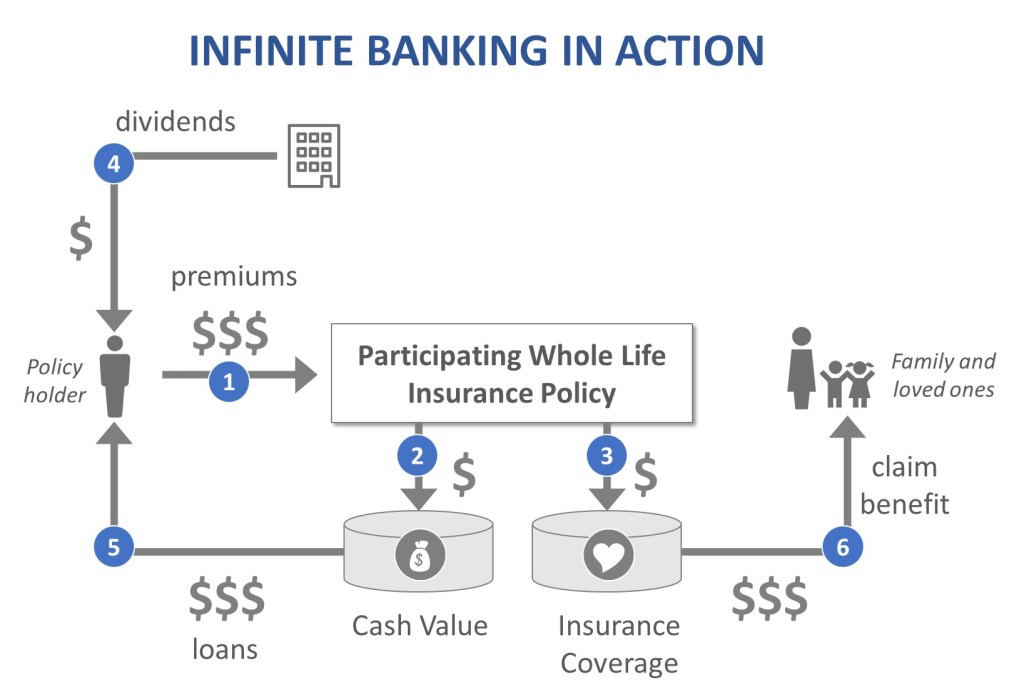

Infinite banking is a complicated financial insurance concept. What’s more, borrowing from a whole life insurance policy rather than a bank introduces a unique set of problems. These loans don’t have set repayment schedules but they do accrue interest. Here’s what you should know about borrowing from an insurance policy:

PROs:

- Easier to secure than a bank loan, especially if you have bad credit.

- May only take a few days to receive funds.

- Interest rates may be lower than other loans.

CONs:

- You may need to pass a physical to qualify for an insurance policy.

- Policy loans can decrease the death benefit.

- Premiums can run significantly higher than comparable term policies

- Payment issues can result in losing your policy and/or paying tax penalties.

- Interest rates may be variable and fixed rates can be high.

- Borrowing limits are often capped at a percentage of the cash value.

- It can take years to accrue enough cash value to take out a significant loan.

CITE: https://www.r2library.com/Resource

COMMENTS APPRECIATED

SUBSCRIBE TO THE ME-P

Thank You

RISK MANAGEMENT AND INSURANCE: https://www.routledge.com/Risk-Management-Liability-Insurance-and-Asset-Protection-Strategies-for/Marcinko-Hetico/p/book/9781498725989

***

Filed under: Ethics, Financial Planning, Funding Basics, Insurance Matters | Tagged: infinite banking, insurance, life insurance, Whole life Insurance |

Leave a comment