DEFINITIONS

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

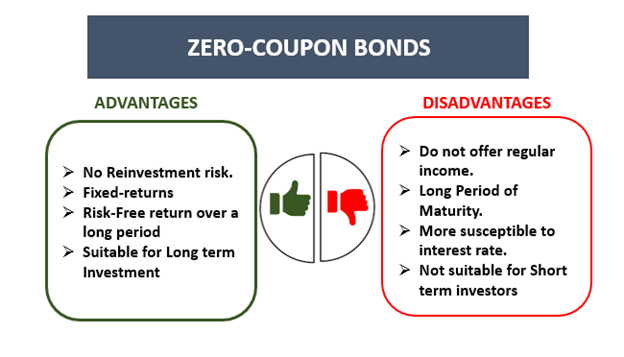

Zero-coupon securities (aka zeros) are debt securities [bonds] that, unlike most of their debt security counterparts, make no periodic interest payments to investors. Instead, they are sold at a deep discount (with an imputed interest rate priced into the discount), then redeemed for their full face value at maturity.

CITE: https://www.r2library.com/Resource/Title/0826102549

When held to maturity, a zero’s entire return comes from the difference between its purchase price and its value at maturity.

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: Glossary Terms, iMBA, iMBA, Inc., Investing, Marcinko Associates, Portfolio Management | Tagged: debt securities, iMBA, Marcinko, zero bonds, zero coupon bonds, zero coupons, Zero-coupon securities, zeros | Leave a comment »