DONATION: In “Name” Only?

Staff Reporters

***

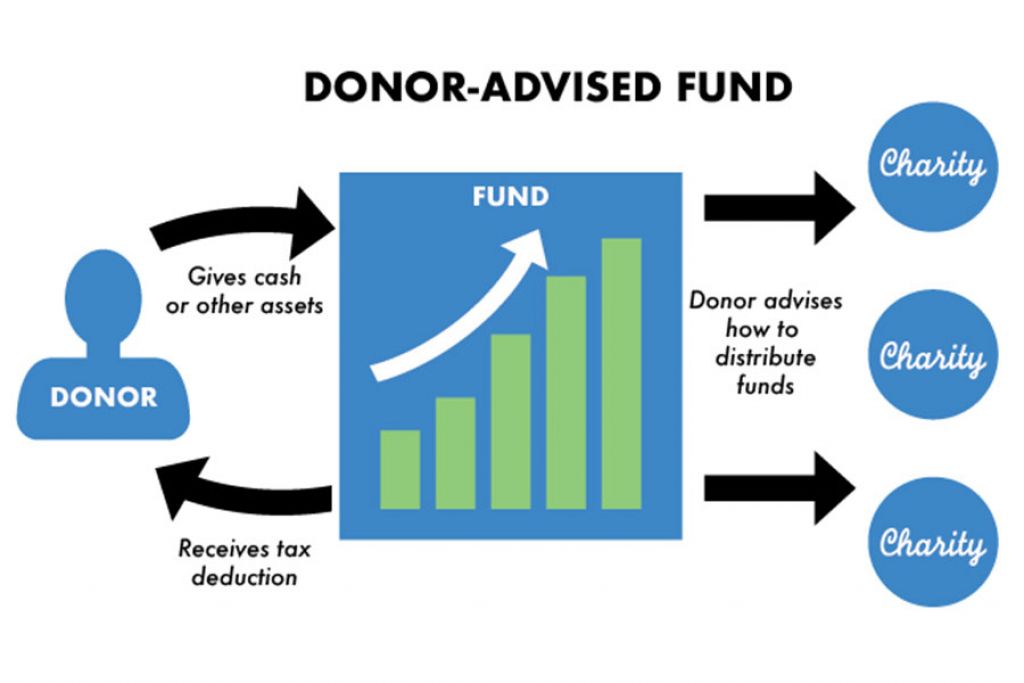

Proponents of DAFs say that their structure encourages giving: The tax deduction encourages wealthy patrons to dedicate money for charity even before they’ve decided which cause to support. “Donors may have good reasons to postpone grants,” a Stanford Law School article says..

In one hypothetical, a tech founder who “sells a startup for millions of dollars” may want to donate her takings but is too busy to immediately decide how to direct the funds; a DAF is a good choice for this person, the law article notes.

However, while DAFs could in theory grow the charitable pie, in practice, they too often allow the donor the illusion of charity while letting them keep control of their funds, critics say.

While a gift to a DAF is treated the same as an outright gift to the Red Cross or United Way, in practice, it “effectively allows the donor to retain ongoing control over the charitable disposition and investment of the donated assets,” tax scholars Roger Colinvaux and Ray Madoff wrote in 2019. What’s more, “donors are under no obligation, and have no incentive, ever to release their advisory privileges to make the funds available for charitable use.”

And ultra wealthy donors get a substantially larger tax break than a middle-class worker. As much as 74 cents of every dollar given to charity comes back to the donor in the form of tax breaks, according to calculations by Colinvaux and Madoff, with the highest-earning donors getting the biggest benefits A person in the top tax bracket would save 37% of their federal income tax for every dollar they contribute with a charitable donation; a similar amount of state income tax; and, depending on what they donate and when, they can also avoid capital gains tax and estate tax. (By contrast, a typical worker who makes about $60,000 and doesn’t own stocks would save 22% from their cash contribution, in addition to any state tax savings.)

What’s more, because there’s no way to track donations from particular DAF accounts, they act as a form of “dark money,” allowing donors to give vast sums, essentially anonymously, to a range of potentially unsavory organizations, including nonprofits that advocate for specific political causes or organizations classified as hate groups, IPS says.

“This allows DAFs to be used to hide transfers — similar to the way the ultra-wealthy use multiple shell companies to hide the movement of money among offshore accounts,” IPS writes.

All of these strategies are completely legal, the IPS notes, as are other potentially questionable tactics used by family foundations—such as paying family members to serve as foundation trustees or act as executives of foundations, sometimes at salaries in the hundreds of thousands of dollars a year. However, the IPS argues, they erode public trust in charities and the tax system overall.

“The fact that billionaires opt out of paying taxes, have these closely held family foundations and get to play God about where the money goes, that’s private power — unaccountable private power,” Collins said.

“At this point philanthropy is at risk of becoming taxpayer-subsidized private power.”

COMMENTS APPRECIATED

Refer a Colleague: MarcinkoAdvisors@msn.com

Your Referral Count: 0

***

***

Filed under: "Advisors Only", "Doctors Only", Accounting, Estate Planning, Ethics, Experts Invited | Tagged: charity, DAF, dark money, donar, donar advised fund, donar advised funds, donation, IPS, Red Cross, United Way | 1 Comment »