By Staff Reporters

***

Hippo Holdings Inc. (NYSE: HIPO) intends to file a proxy statement with the Securities and Exchange Commission in connection with a special meeting of stockholders to be held on August 31, 2022. The proxy statement will include a proposal for a reverse stock split at a ratio in the range of 1-for-20 to 1-for-30 and the reduction of the number of authorized shares of capital stock of the company by a corresponding proportion.

The reverse stock split to be proposed to Hippo stockholders in the proxy statement is intended to resolve the issue raised in a non-compliance notice Hippo received from the New York Stock Exchange (the “NYSE”) on July 19, 2022 regarding Section 802.01C of the NYSE Listed Company Manual due to the average closing price of the company’s common stock being less than $1.00 over a consecutive 30 trading-day period. The notification has no immediate effect on the listing or trading of Hippo’s common stock on the NYSE.

Hippo can regain compliance at any time within the six-month period following receipt of the NYSE notice if on the last trading day of any calendar month during the cure period the company has a closing price of at least $1.00 per share and an average closing price of at least $1.00 per share over the 30-trading day period ending on the last trading day of that month.

***

***

SO – WHAT EXACTLY IS A REVERSE STOCK SPLIT?

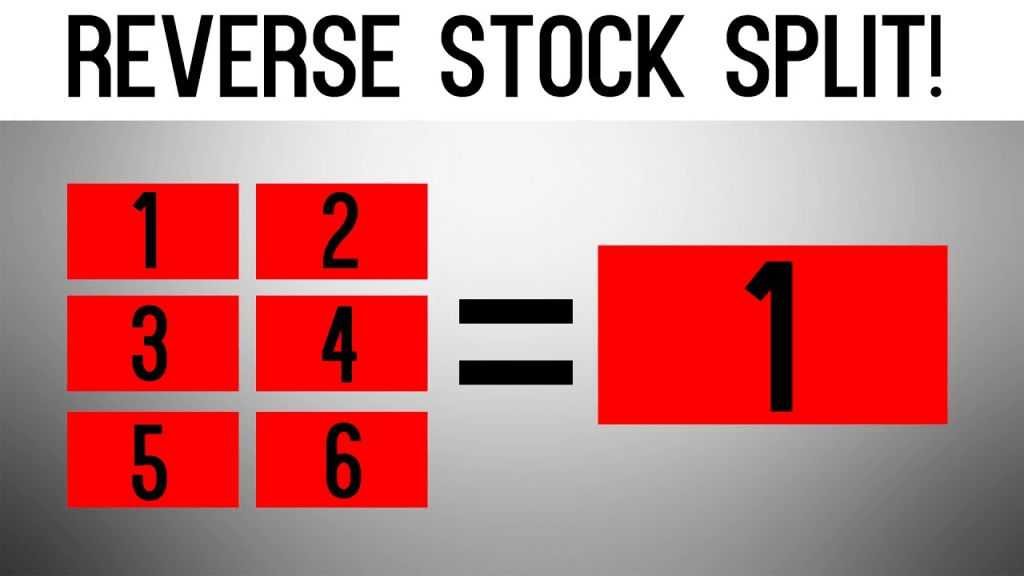

A reverse stock split is a type of corporate action that consolidates the number of existing shares of stock into fewer (higher-priced) shares.

A reverse stock split divides the existing total quantity of shares by a number such as five or ten, which would then be called a 1-for-5 or 1-for-10 reverse split, respectively.

A reverse stock split is also known as a stock consolidation, stock merge, or share rollback and is the opposite of a stock split, where a share is divided (split) into multiple parts.

CITE: https://www.r2library.com/Resource/Title/0826102549

What are pros and cons of a reverse stock split?

- Companies prices come down

- Outstanding shares goes up, with this their financial ratios like EPS, RoE goes down.

- Market cap remains same.

- No Fresh equity are issued hence there is no dilution of equity.

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: Glossary Terms, Health Economics, Investing | Tagged: HH, Hippo Holdings, reverse stock split, stock split, What Is a "Reverse" Stock Split? | 2 Comments »