By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

The Origins and Current Status of Cryptocurrency: A 2025 Perspective

Introduction

Cryptocurrency has evolved from a niche technological experiment into a global financial force. In just over a decade, it has disrupted traditional banking, inspired new economic models, and sparked debates about the future of money. As of 2025, cryptocurrencies are not only investment assets but also tools for innovation, decentralization, and financial inclusion. This essay explores the origins of cryptocurrency, its evolution, and its current status in the global economy.

Origins of Cryptocurrency

The Pre-Bitcoin Era

Before Bitcoin, digital currency was a theoretical concept explored by cryptographers and computer scientists. In the 1980s, David Chaum introduced DigiCash, an early form of electronic money that prioritized privacy. Though innovative, DigiCash failed commercially due to lack of adoption and centralization.

Other attempts, like Hashcash and B-money, laid the groundwork for decentralized systems but never materialized into functioning currencies. These efforts, however, contributed key ideas that would later be incorporated into Bitcoin.

REAL MONEY: https://medicalexecutivepost.com/2025/03/27/cryptocurrency-real-money-or-not/

The Birth of Bitcoin

In 2008, an anonymous figure (or group) known as Satoshi Nakamoto published the Bitcoin white paper: “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document proposed a decentralized currency that used blockchain technology to validate transactions without a central authority.

Bitcoin officially launched in January 2009 with the mining of the genesis block. Early adopters were cryptographers, libertarians, and tech enthusiasts. The first real-world Bitcoin transaction occurred in 2010 when Laszlo Hanyecz paid 10,000 BTC for two pizzas — now commemorated as Bitcoin Pizza Day.

Bitcoin’s design solved the double-spending problem and introduced a transparent, immutable ledger. Its supply was capped at 21 million coins, making it deflationary by design.

Evolution and Expansion

Rise of Altcoins

Bitcoin’s success inspired the creation of alternative cryptocurrencies, or “altcoins.” Litecoin (2011), Ripple (2012), and Ethereum (2015) introduced new functionalities. Ethereum, in particular, revolutionized the space by enabling smart contracts — self-executing agreements coded directly onto the blockchain.

Smart contracts laid the foundation for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). These innovations expanded crypto’s use cases beyond simple transactions.

ICO Boom and Regulatory Pushback

In 2017, the crypto market experienced a massive bull run fueled by initial coin offerings (ICOs). Startups raised billions by issuing tokens, often without clear business models or regulatory oversight. While some projects succeeded, many failed or turned out to be scams.

Governments responded with crackdowns. The U.S. Securities and Exchange Commission (SEC) began classifying certain tokens as securities, requiring registration and compliance. China banned ICOs and crypto exchanges altogether.

Despite the volatility, the 2017–2018 cycle cemented crypto’s place in mainstream finance and attracted institutional interest.

Cryptocurrency in the 2020s

COVID-19 and the Digital Gold Narrative

The COVID-19 pandemic in 2020 accelerated crypto adoption. As governments printed trillions in stimulus, concerns about inflation grew. Bitcoin was increasingly viewed as “digital gold” — a hedge against fiat currency devaluation.

Major companies like Tesla, MicroStrategy, and Square added Bitcoin to their balance sheets. PayPal and Visa began supporting crypto transactions. The narrative shifted from speculation to legitimacy.

Ethereum and the DeFi Explosion

Ethereum’s ecosystem exploded with the rise of DeFi platforms like Uniswap, Aave, and Compound. These services allowed users to lend, borrow, and trade assets without intermediaries. Total value locked (TVL) in DeFi surpassed $100 billion by 2021.

Ethereum also became the backbone of the NFT boom. Artists, musicians, and creators used NFTs to monetize digital content, leading to record-breaking sales and mainstream attention.

STABLE COINS: https://medicalexecutivepost.com/2023/08/11/paypal-crypto-stablecoin-pyusd/

Current Status of Cryptocurrency (2025)

Market Performance

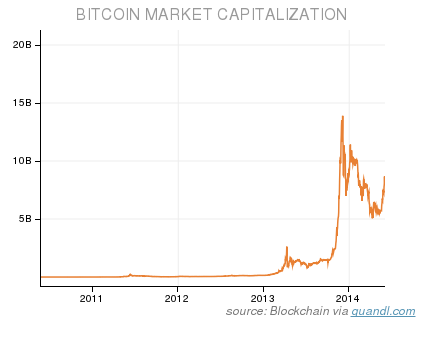

As of 2025, the global cryptocurrency market has added over $600 billion in value year-to-date, with a total market capitalization exceeding $2.5 trillion.

CRYPTO INFLATION: https://medicalexecutivepost.com/2022/08/27/inflation-and-crypto-currency/

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Alternative Investments, Financial Advisor Listings, Glossary Terms, Marcinko Associates | Tagged: Aave, altcoins, B-money, Bitcoin, blockchain, crypto, crypto-currency, cryptocurrency, DeFi, DigiCash, digital gold, Etherium, Hashcash, ICO boom, Laszlo Hanyecz, Litecoin, Marcinko, MicroStrategy, NFT, Satoshi Nakamoto, Tesla, Uniswap | Leave a comment »