By Staff Reporters

***

***

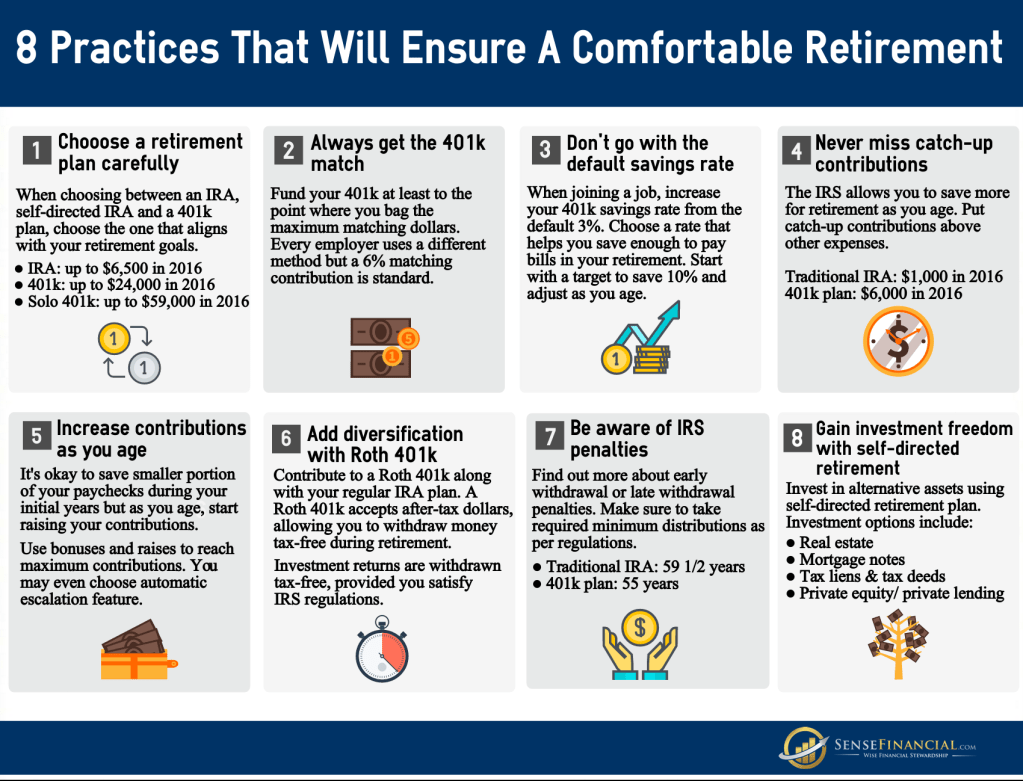

The IRS just said that the maximum contribution that an individual can make in 2023 to a 401(k), 403(b) and most 457 plans will be $22,500. That’s up from $20,500 this year.

People aged 50 and over, which have the option to make additional “catch-up” contributions to 401(k) and similar plans, will be able to contribute up to $7,500 next year, up from $6,500 this year. That’s means a 401(k) saver who is 50 or older can contribute a maximum of $30,000 to their retirement plan in 2023.

The IRS also raised the 2023 annual contribution limits on individual retirement arrangements, or IRAs, to $6,500, up from $6,000 this year. The IRA “catch-up” contribution limit remains at $1,000, as it’s not subject to an annual cost of living adjustment, the IRS said.

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Accounting, Breaking News, Experts Invited, Investing, Retirement and Benefits, Taxation | Tagged: IRS, retirement plans, retirement savings plans | 1 Comment »