By Staff Reporters

***

***

Convertible Arbitrage

Convertible arbitrage is the oldest market-neutral strategy. Designed to capitalize on the relative mispricing between a convertible security (e.g. convertible bond or preferred stock) and the underlying equity, convertible arbitrage was employed as early as the 1950s.

Since then, convertible arbitrage has evolved into a sophisticated, model-intensive strategy, designed to capture the difference between the income earned by a convertible security (which is held long) and the dividend of the underlying stock (which is sold short). The resulting net positive income of the hedged position is independent of any market fluctuations. The trick is to assemble a portfolio wherein the long and short positions, responding to equity fluctuations, interest rate shifts, credit spreads and other market events offset each other.

***

***

Hedge Fund Research (HFR) New York, offers the following description of the strategy

Convertible Arbitrage involves taking long positions in convertible securities and hedging those positions by selling short the underlying common stock. A manager will, in an effort to capitalize on relative pricing inefficiencies, purchase long positions in convertible securities, generally convertible bonds, convertible preferred stock or warrants, and hedge a portion of the equity risk by selling short the underlying common stock. Timing may be linked to a specific event relative to the underlying company, or a belief that a relative mispricing exists between the corresponding securities. Convertible securities and warrants are priced as a function of the price of the underlying stock, expected future volatility of returns, risk free interest rates, call provisions, supply and demand for specific issues and, in the case of convertible bonds, the issue-specific corporate/Treasury yield spread. Thus, there is ample room for relative mis-valuations.

Because a large part of this strategy’s gain is generated by cash flow, it is a relatively low-risk strategy.

COMMENTS APPRECIATED

Read, Like, Refer and Subscribe

***

***

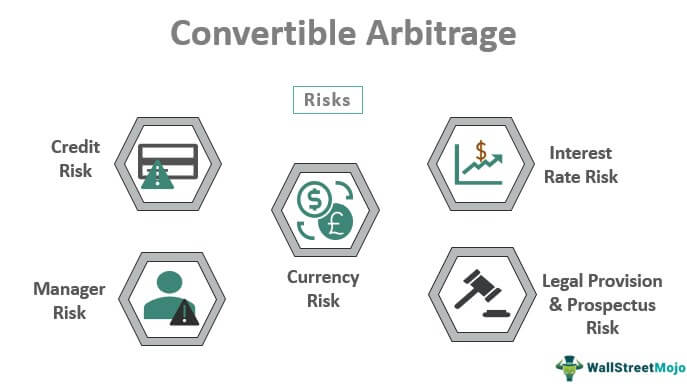

Filed under: "Ask-an-Advisor", Alternative Investments, Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: arbitrage, convertible arbitrage, credit risk, currency risk, finance, interest rate risk, Investing, investment, manager risk, Market Neutral Funds, personal-finance, prospectus risk, stocks | Leave a comment »