Both Hippocratic and Patriotic

By D. Kellus Pruitt DDS

For the benefit of our trusting patients, let’s start openly discussing the unethical practices of dental insurance companies’ right here. Marketplace conversation about deceit in healthcare is not only the Hippocratic thing to do, but once the awkwardness wears off, it’s really, really fun sport. We simply must lower the cost of dental care in the nation, and I say we start with dental insurance executives’ salaries and bonuses. Are you with me; Doctor? And let’s not forget all the non-productive busywork insurance companies never reimburse us for.

Are you Fed Up?

Are you fed up with successfully doing intricate handwork to exacting tolerances in mouths of anxious patients and then having to fight to get the patients’ insurance company to pay what they rightfully owe THEIR CLIENT? Are you tired of the way anonymous and unaccountable insurance employees treat you and your staff when their company’s contractual relationship is not with anyone in your office?

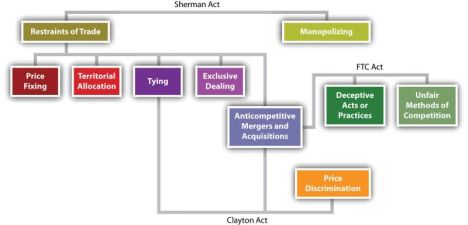

In my opinion, Delta Dental, United Concordia, UnitedHealth, BCBSTX and most other secretive dental insurance companies have been cheating Americans for decades under the cover of the McCarran-Ferguson Act of 1945 – which protects them from prosecution by the FTC and cries out to be repealed (tell your Congressperson).

The Age of Transparency

Even in the age of transparency, old habits die hard, especially when there is a profit and campaign funds involved. Dental “insurance” has always harbored fraudulent business activities and has never made sense as a wise purchase – even if one doesn’t brush their teeth. It’s a business built on complicated rules, client deceit and intrusion into their relationship with their dentist.

Dental insurance crime as policy has long avoided market correction because up until now, dentists had no control over the media (and dentistry is boring). Not unexpectedly, when business entities are shielded from accountability in an otherwise free market, it is always the clueless consumer who wastes money on lousy dental insurance policies.

IMHO

In my opinion, employers should be offering their employees the choice of cash or dental insurance. Then let Adam Smith’s invisible hand of competition spank the butts of the greedy and deceitful.

Dentists

Dentists, if you were given the opportunity to effectively voice your opinion directly to employers who carelessly purchase bad dental plans they know nothing about according to the appearance of an ad, what would you say? So why aren’t you saying it right here, right now? If not now, when, Doc?

Assessment

If you don’t make your complaints known, do you think MBA benevolence will eventually improve the dental insurance industry in the nation? I say we do what feels natural and bitch. Let’s live on the wild side and take our chances on someone calling us “unprofessional.” We owe it to our patients to promote honesty in our community. Otherwise, how can your silence possibly help your patients?

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Health Insurance, Op-Editorials, Pruitt's Platform | Tagged: BCBSTX, D. Kellus Pruitt DDS, delta dental, dental insurance, McCarran-Ferguson Act, United Concordia, UnitedHealth | 15 Comments »