THE RESULTS ARE IN

By Staff Reporters

***

***

Investment portfolios owned by individual investors have lost a combined $350 billion this year, Bloomberg reports. The average retail trader’s portfolio is down 30% in 2022, compared to the S&P’s 17% loss, per Vanda Research. Some estimates put the damage as even worse than that: JPMorgan calculates that retail traders are down 38% this year.

As they’ve watched their portfolios crumble further than SBF’s credibility, these traders aren’t trading nearly as much as they did during peak Covid.

- At the apex of the meme stock craze in Q1 2021, Charles Schwab was handling 8.4 million daily average trades. In Q3 of this year, it recorded 5.5 million.

- Robinhood, both an enabler and the villain of the individual trader movement, shed 1.8 million users between Q2 and Q3 this year.

So what happened?

Individual investors piled into a specific set of stocks during the height of the pandemic, and those stocks in particular are getting rocked by shifting trends and the Fed’s rate hikes. Just consider that Tesla, by itself, accounts for ~10% of the average active retail trader’s portfolio. So as the stock plunged ~55% this year, it wiped out $78 billion in value for retail investors, per Vanda.

As for meme stocks?

Good luck trying to send a struggling company to the moon these days. GameStop is down nearly 41% this year, and after its dud of an earnings report this week one analyst wrote that “GameStop’s turnaround plan has proven fruitless so far,” specifically citing the poor performance of its NFT marketplace.

CITE: https://www.r2library.com/Resource/Title/082610254

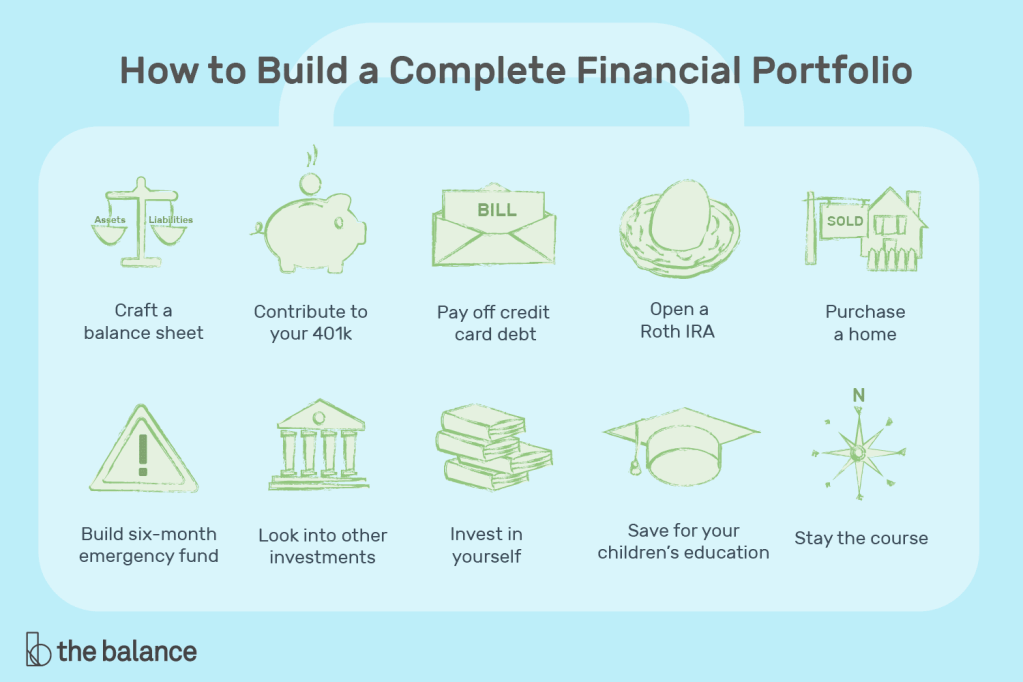

And so, with retail traders riding the bench during the market downturn, the companies that rely on them for revenue are having to switch up their tactics. This week, according to Neal Freyman of Morning Brew, Robinhood introduced retirement accounts (traditional or Roth IRAs) with a 1% match to lure back users. It may not be a flashy product, but as investors who got burned this year have realized, there are worse things than being boring.

WHAT ABOUT PHYSICIAN INVESTORS?

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Health Economics, Investing, Risk Management | Tagged: Individual Investors, Investment Portfolios?, Investment [Financial] Portfolios, portfolios | Leave a comment »