Dr. David Edward Marcinko MBA MEd

***

***

Crisis Management in Medical Practice

Healthcare is a field where crises are not hypothetical but expected realities. From pandemics and natural disasters to cyberattacks and sudden staff shortages, medical practices must be prepared to respond swiftly and effectively. Crisis management in medical practice refers to the structured approach of anticipating, preparing for, responding to, and recovering from disruptive events that threaten patient safety, organizational stability, or community trust.

🌐 Nature of Crises in Healthcare

Crises in medical practice can take many forms:

- Public Health Emergencies: Outbreaks of infectious diseases, such as COVID-19, demand rapid adaptation of protocols and resources.

- Operational Disruptions: Power outages, supply chain breakdowns, or IT failures can halt essential services.

- Human Resource Challenges: Sudden staff shortages due to illness or burnout can compromise patient care.

- Reputation and Legal Risks: Medical errors or breaches of patient confidentiality can escalate into crises requiring immediate management.

Each type of crisis requires tailored strategies, but all share the common need for preparedness and resilience.

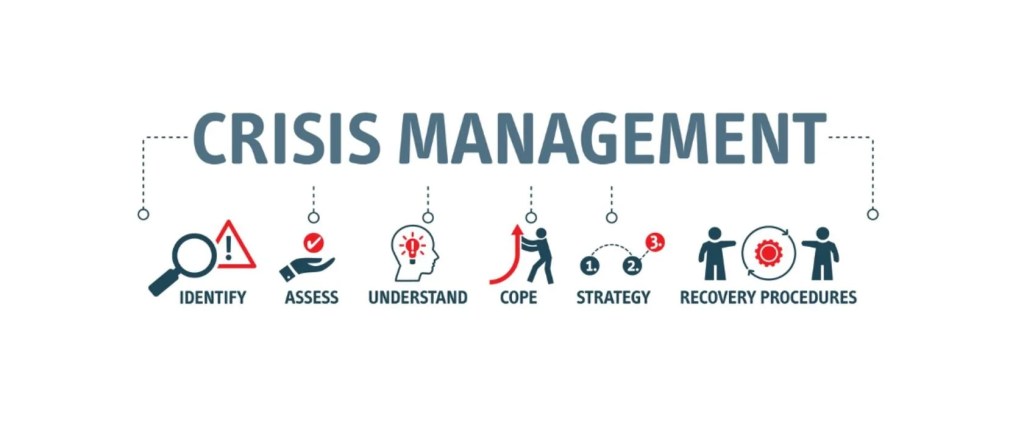

🔑 Principles of Crisis Management

Effective crisis management in medical practice rests on several key principles:

- Preparedness: Developing contingency plans, conducting drills, and maintaining emergency supplies ensure readiness.

- Leadership and Decision-Making: Strong leadership is critical for making rapid, evidence-based decisions under pressure.

- Communication: Transparent, timely communication with staff, patients, and external stakeholders reduces panic and builds trust.

- Collaboration: Coordinating with hospitals, public health agencies, and community organizations strengthens response capacity.

- Flexibility: Crises are unpredictable; adaptability in protocols and resource allocation is essential.

⚙️ Crisis Management Frameworks

Healthcare organizations often adopt structured frameworks:

- Incident Command System (ICS): Provides a standardized hierarchy for managing emergencies.

- Risk Assessment Models: Identify vulnerabilities and prioritize mitigation strategies.

- Business Continuity Planning: Ensures essential services continue despite disruptions.

These frameworks help medical practices move from reactive responses to proactive resilience.

***

***

💡 Challenges in Crisis Management

Despite planning, medical practices face significant challenges:

- Resource Limitations: Smaller practices may lack the financial or logistical capacity to implement robust crisis plans.

- Staff Stress and Burnout: Crises often demand long hours and emotional resilience, which can strain healthcare workers.

- Rapidly Changing Information: In public health emergencies, evolving guidelines can create confusion.

- Patient Expectations: Maintaining quality care during disruptions is difficult but essential to preserve trust.

Addressing these challenges requires investment in training, mental health support, and technology infrastructure.

🌱 Importance of Resilience

Crisis management is not only about survival but about building resilience. Practices that learn from crises, adapt policies, and strengthen systems emerge stronger. For example, the COVID-19 pandemic accelerated telemedicine adoption, which continues to benefit patients today. Resilience ensures that medical practices can withstand future disruptions while continuing to deliver safe, effective care.

✅ Conclusion

Crisis management in medical practice is a vital competency that safeguards both patients and providers. By preparing for diverse scenarios, fostering strong leadership, and prioritizing communication, healthcare organizations can navigate crises with confidence. Ultimately, effective crisis management transforms challenges into opportunities for growth, innovation, and improved patient care.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Drugs and Pharma, Ethics, Glossary Terms, Management, Marcinko Associates | Tagged: crisis, crisis management, crisis management healthcare, crisis management meicine, david marcinko, digital marketing, health, healthcare, ICs, Incident Command System, public health, reputation management | Leave a comment »