WHAT IS A DONOR ADVISED FUND?

Sponsor: http://www.CertifiedMedicalPlanner.org

***

***

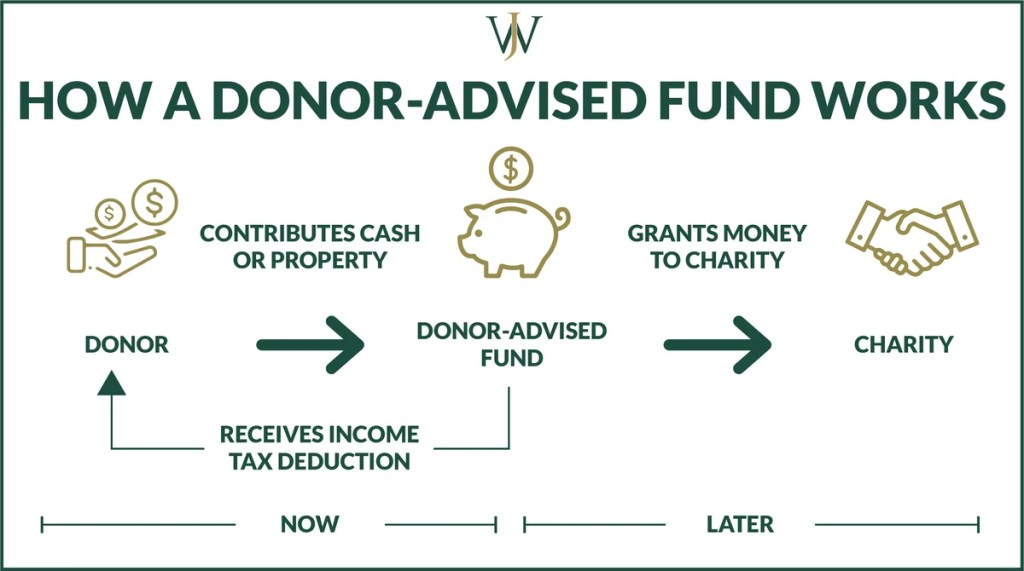

A donor-advised fund is a private account created to manage and distribute charitable donations on behalf of an organization, family, or individual. Donor-advised funds can democratize philanthropy by aggregating the contributions of multiple donors, thus multiplying their impact on worthy causes. Donor-advised funds also have abundant tax advantages.

DONOR DEPENDENCY: https://medicalexecutivepost.com/2025/01/02/culture-donation-dependency/

Donor-advised funds have become increasingly popular, as they offer the donor greater ease of administration while still allowing them to maintain significant control over the placement and distribution of charitable gifts. But, unlike private foundations, donor-advised fund holders enjoy a federal income tax deduction of up to 60% of adjusted gross income (AGI) for cash contributions and up to 30% of AGI for the appreciated securities they donate. Donors to these funds can contribute cash, stock shares, and other assets. When they transfer assets such as limited-partnership interests, they can avoid capital gains taxes and receive immediate fair market value tax deductions.

MEDICAL ETHICS: https://medicalexecutivepost.com/2024/06/20/medical-ethics-physician-and-financial-organizations/

According to the National Philanthropic Trust’s 2023 Donor-Advised Fund Report, these funds have continued to grow in recent years, despite some headwinds including the Covid-19 pandemic and occasional stock market setbacks. Total grants awarded by donor-advised funds in 2022 increased by 9% to $52.16 billion, while total contributions rose by 9% to $85.5 billion.

Many donor-advised funds accept non-cash assets—such as checks, wire transfers, and cash positions from a brokerage account—in addition to cash and cash equivalents.

Donating non-cash assets may be more beneficial for individuals and businesses, leading to bigger tax bigger write-offs.

PHILANTHROPY: https://medicalexecutivepost.com/2021/11/15/national-philanthropy-day-2021/

COMMENTS APPRECIATED

Like and Refer

***

***

Filed under: "Ask-an-Advisor", Accounting, Alternative Investments, CMP Program, Ethics, Financial Planning, Glossary Terms, Investing, Marcinko Associates | Tagged: AGI, CMP, DAF, donor advised fund, Donor Advised Funds (DAF)., Estate Planning, Ethics, FMV, Marcinko, philanthropy | Leave a comment »