A Private Investment in Public Equity

By Staff Reporters

***

***

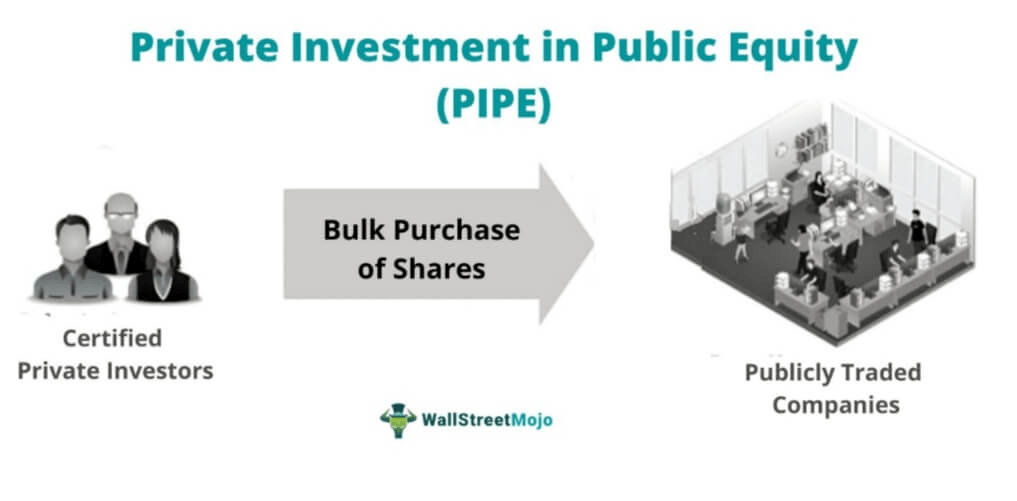

- A private investment in public equity (PIPE) is a transaction in which a publicly traded company sells shares to accredited investors via a private placement.

- In a PIPE transaction, an investor commits to buying a certain number of shares at a fixed price and, in exchange, the issuer provides a resale registration statement.

- In a non-traditional PIPE transaction, the security price may be variable instead of fixed, and investors must pay before receiving the resale registration statement in return.

- While PIPE transactions can be advantageous to both the firm and the accredited investor, most investors can’t participate, and the deal may dilute the shares of existing stockholders.

- MORE: https://www.nasdaq.com/glossary/p/private-investment-in-public-equity

- RELATED: https://medicalexecutivepost.com/2022/06/13/spac-v-direct-listing-v-ipo/

***

COMMENTS APPRECIATED

Thank You

***

DHEF: https://medicalexecutivepost.com/2022/09/24/what-is-the-size-effect-in-finance/

***

Filed under: Glossary Terms, Investing | Tagged: financial PIPE, PIPE, What is a Financial PIPE? | Leave a comment »