A Political Discourse by Kevin Outterson

[By Staff Reporters]

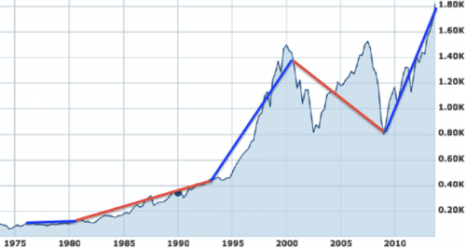

The Dow hit an inflation adjusted record high this week (WSJ). Here is the (unadjusted) S&P since 1975 with Republican administrations in red and Democrats in blue.

Before you jump to partisan conclusions, last month, Tyler Cowan reviewed the Blinder and Watson paper on why Democrats preside over superior economic performance (their conclusion: mostly good luck).

Source: Bull markets under Democrats

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Health Law & Policy, Investing, Portfolio Management |

Bullish?

Did you know that the American Association of Individual Investors just said its gauge of bullish sentiment jumped to the highest level since January 2011?

Yet, another reason why US stock mutual funds aren’t growing even faster is that individual investors are parking more money in other types of funds and other parts of the world.

For example, from 2006 through the end of 2012, US stock ETFs had inflows of $353.5 billion. ETFs have taken in an additional $86 billion in the year through November.

And, BlackRock Inc. estimated that about 65 percent of U.S. ETF assets are held by advisers on behalf of individuals or directly by individuals.

Moreover, international stock mutual funds took in $97 billion in 2013 as of the end of November, according to Lipper.

Jorge

LikeLike

Yale vs. Penn

[Where are stocks headed?]

If you’re trying to be a successful market timer, to buy or sell before the masses, well, you’ve got your work cut out.

Robert Shiller is a Nobel laureate, an economist and a professor at Yale. Jeremy Siegel is a respected professor of finance at Pennsylvania’s Wharton School.

http://www.marketwatch.com/story/yale-vs-penn-where-are-stocks-headed-2014-08-22?reflink=e2emsn

And, they appear to disagree over the likely direction of stocks. What do you think?

BTW: I just ordered this new text book; good TOC and contributors.

Dr. Leshi

LikeLike

How to tell if you’re a stock market bull or bear?

Are you more swayed by the Fed’s easy-money policy, or by corporate earnings and other fundamentals?

http://money.msn.com/top-stocks/post–how-to-tell-if-youre-a-stock-bull-or-bear

It has been a crazy and volatile week.

Margie

LikeLike

We’re 6 years into 20-year bull market

U.S. markets are six years into a 20-year bull market, Brian Belski, chief investment strategist at BMO Capital Markets, recently opined.

http://www.msn.com/en-us/money/markets/were-6-years-into-20-year-bull-market-belski/ar-BBfAmtN?ocid=iehp

“It’s the biggest stealth bull market of my 20-year career. Nobody believes it and we’re not there yet.”

Jurgen

LikeLike

How long will the bull market last?

Since the U.S. stock market bottomed out in March 2009, stocks have steadily climbed to new heights. Annual gains have been above the historical average of about 10%. For example, during the past five years, as of June 30, U.S. stocks rose an average of 17.5% per year (as measured by the Dow Jones U.S. Total Stock Market Float Adjusted Index).

The market’s performance ranks as one of the longest bull markets in modern U.S. history. However, bull markets do experience an occasional correction, typically defined as a pullback of at least 10%. The most recent one occurred in 2011.

Why it’s important

The long run of the bulls has raised the question: How long can it keep going? Of course, predicting the future twists and turns of the market is notoriously difficult. But, downturns can be beneficial for the long-term health of the market. Whether small or large, pullbacks have always laid the groundwork for subsequent gains as money that was sidelined is put back to work in equities.

So, we’re cautioning [physician] investors to have realistic expectations for future market returns and to recognize that a correction does not always lead to a bear market.

Looking at the long term, our own outlook for stocks over the next decade is a bit more modest than the market’s historical average. Our projections favor future average annual returns in the range of 6% to 9% over the next ten years.

What do you think?

Dr. David Edward Marcinko MBA CMP™

LikeLike

UPDATE

MLK Holiday Weekend 2017

U.S. stocks rallied since the U.S. presidential election and have now advanced for eight straight calendar years. Meanwhile, bond prices have dropped in recent months, and yields have risen amid the anticipation of faster economic growth, higher inflation, and further hikes in short-term rates by the Federal Reserve.

In fact, and against this backdrop, Vanguard Chairman and CEO Bill McNabb and Vanguard Chief Investment Officer Tim Buckley recently discussed their expectations for the economy and financial markets.

So, investors are wondering how President-elect Trump’s policies might affect the economy and financial markets.

The possibility of less government regulation, fiscal stimulus including infrastructure spending, and tax reform have contributed to stocks’ recent climb. But, Buckley pointed out that stocks’ recent surge has been based on speculation, and that investors should not draw conclusions about how markets will behave under a new administration based on what happens between the election and inauguration.

McNabb and Buckley agreed that company fundamentals, rather than who is sitting in the White House, drive longer-term stock market returns, and that the recent market rally hasn’t been accompanied by a change in those fundamentals.

They expect stocks and bonds to perform below their long-term averages in the next decade given their fairly high valuations and low yields, respectively. But, McNabb and Buckley also feet equities still provide opportunities for growth and are an essential part of a well-diversified portfolio while the benefits of bonds as a diversifier will persist.

“Diversify globally, but think locally about your asset allocation,” Political changes shouldn’t affect your asset allocation so much as your own personal (“local”) goals, investment horizon, and tolerance for risk.

Your thoughts and comment are appreciated.

Dr. David E. Marcinko MBA

LikeLike