By Staff Reporters

***

***

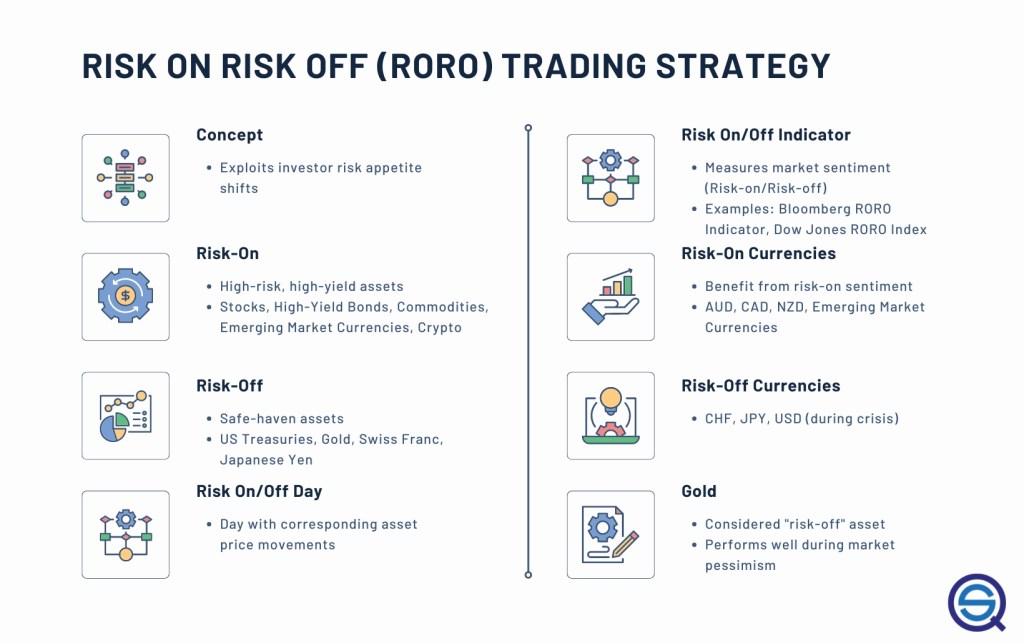

Risk-On

RO = Asset prices commonly follow the risk sentiment of the market. Investors look for changing sentiment through corporate earnings, macro-economic data, and global central bank action. An increase in the stock market or where stocks outperform bonds is said to be a risk-on environment.

Risk-on environments can be carried by expanding corporate earnings, optimistic economic outlook, accommodative central bank policies, and speculation. As the market displays strong influential fundamentals, investors perceive less risk about the market and its outlook.

Risk-Off

ROff = When stocks are selling off, and investors run for shelter to bonds or gold, the environment is said to be risk-off. Risk-off environments can be caused by widespread corporate earnings downgrades, contracting or slowing economic data, and uncertain central bank policy.

Just like the stock market rises in a risk-on environment, a drop in the stock market equals a risk-off environment. Investors jump from risky assets and pile into high grade bonds, U.S. Treasury bonds, gold, cash, and other safe havens

Risk-On Risk-Off?

Risk-on-risk-off investing relies on and is driven by changes in investor risk tolerance. Risk-on-risk-off (RORO) can also sway changes in investment activity in response to economic patterns. When risk is low, investors tend to engage in higher-risk investments. Investors tend to gravitate toward lower-risk investments when risk is perceived to be high.

Note: Thanks to Chat GPT.

COMMENTS APPRECIATED

Subscribe and Refer

***

***

Filed under: Experts Invited, Financial Planning, Funding Basics, Glossary Terms | Tagged: finance, Investing, personal-finance, risk, risk off, risk on, RORO, stock market, stock trading, stocks, trading strategies | Leave a comment »