By Staff Reporters

***

***

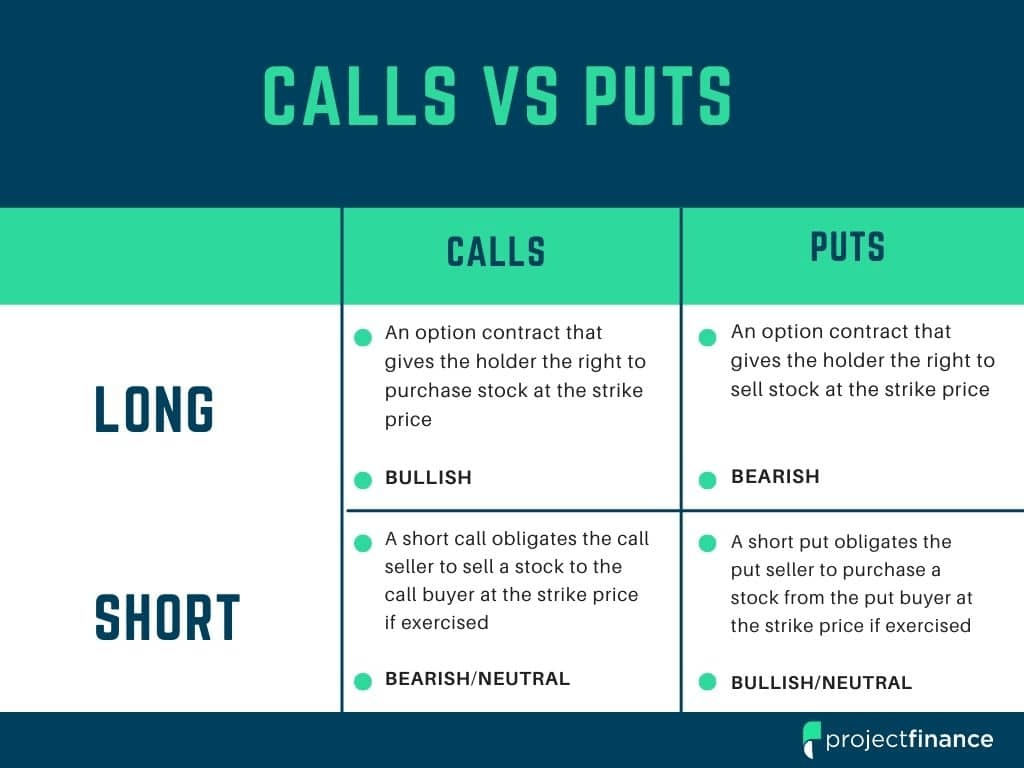

Options are contracts that give investors the right to buy or sell stocks, indexes or other financial securities at an agreed upon price and date. Puts are the option to sell while calls are the option to buy.

Specifically – A Call Option gives the buyer the right, but not the obligation to buy the underlying security at the exercise price, at or within a specified time. A Put Option gives the buyer the right, but not the obligation to sell the underlying security at the exercise price, at or within a specified time.

Ratio – When the ratio of puts to calls is rising, it is usually a sign investors are growing more nervous. A ratio above 1 is considered bearish. The Fear & Greed Index uses a bearish options ratio as a signal for Fear.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alternative Investments, Glossary Terms, Health Economics, Investing, Portfolio Management | Tagged: calls, options, options ratio, puts, stock options | Leave a comment »