There are 259,000 mHealth apps now

ralf.jahns@research2guidance.com

Almost 100,000 mHealth apps have been added since the beginning of last year, amounting to 259,000 currently available on major app stores. In addition, 13,000 mHealth publishers have entered the market since the beginning of 2015, totaling 58,000. The largest global study on mHealth app publishing reveals a massive increase in competition in the mHealth app market.

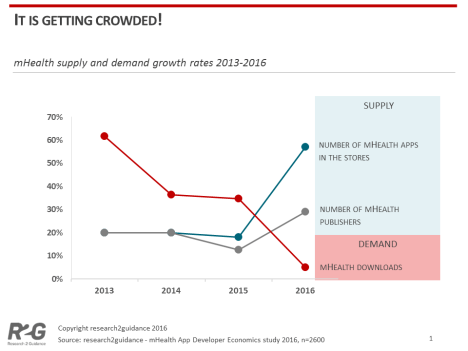

The results of this year’s mHealth App Developer Economics 2016 study show a steep increase in competition level among mHealth app publishers. The supply side of mHealth apps is measured in the number of available apps and publishers. They are growing significantly faster than the demand side which is quantified by the number of mHealth app downloads. The number of mHealth apps and active mHealth app publishers has seen strong growth since 2015. This year, the total number of mHealth apps listed on major app stores across the globe grew by 57% to 259,000 apps.

“This impressive growth is based on three main developments; the growing number of mHealth app publishers, the increased importance of multi-platform app publishing and the expansion of existing mHealth app portfolios”

The number of mHealth app publishers grew in line with the number of apps. There are currently 58,000 mHealth app publishers app on major app stores, 28% more since the beginning of 2015. There appears to be no immediate end to the number of companies rushing into the market to launch their first mHealth app. Multi-platform publishing also contributes to the growth on the supply side of the mHealth app market.

***

***

Currently 75% of mHealth publishers are developing their mHealth apps both on iOS and Android platforms. Multi-platform publishing is even more significant for HTML5 and Windows Phone developers, however these platforms are still niche and don’t contribute a lot to the overall number of mHealth apps yet.

In contrast, growth rates of mHealth app store downloads are estimated to be only +7% in 2016, having been +35% the previous year, reaching a total of 3.2B in 2016. This is in line with other app market categories and reflects the fact that growth of capable devices that can download apps has slowed down in most western countries. As a consequence of this increased competition, it will be even more difficult to stand out and gain significant downloads. Only 14% of mHealth app publishers generated more than 100,000 downloads with their mHealth app portfolio in one year. This share increased only marginally by 3pp since 2014.

“Consumers are still downloading mHealth apps because they have heard about them or found them in the app store” explains Audrone Skardziute, Analyst at research2guidance. “The next push on the demand side will come from recommendations of traditional healthcare companies that are pushing apps to their employees or members.”

With hundreds of new mHealth apps released daily, companies have to consider their app launch as if it were a familiar product in a saturated market. The mHealth Developer Economics 2016 research program is the largest research program about mHealth app publishing. This year more than 2,600 mHealth app developers and decision makers participated and shared their experiences and views about the mHealth app market. There is much more and we will continue to write about the results of the study. Read the full report to see all results.

MORE: Download the free 28 page report here.

About

research2guidance is a Berlin-based mobile app economy specialist. The company’s service offerings include app strategy consulting, market studies and research.

Link to the report:

http://research2guidance.com/product/mhealth-app-developer-economics-2016/

Link to the blog post: http://research2guidance.com/2016/10/11/mhealth-app-market-getting-crowded-259000-mhealth-apps-now/ Link to the image: http://research2guidance.com/wp-content/uploads/2016/10/It-is-getting-crowded.png

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

***

Filed under: Information Technology | Tagged: mHealth, mHealth apps, Ralf-Gordon Jahns, research2guidance | Leave a comment »