By Staff Reporters

***

The market is made up of thousands of stocks. And on any given day, investors are actively buying and selling them. This measure looks at the amount, or volume, of shares on the NYSE that are rising compared to the number of shares that are falling.

Link: https://medicalexecutivepost.com/2022/05/01/what-up-vix/

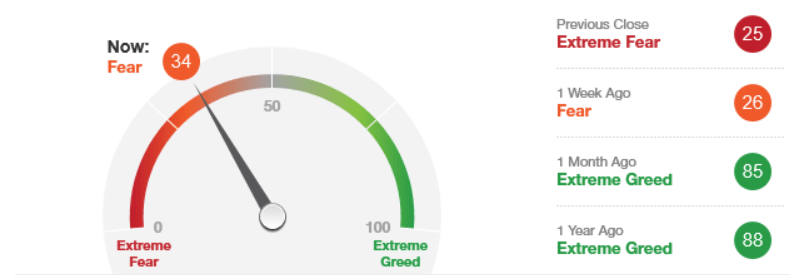

A low (or even negative) number is a bearish sign. The Fear & Greed Index uses decreasing trading volume as a signal for Fear.

CITE: https://www.r2library.com/Resource/Title/0826102549

The formula: Breadth Line Value= (No. of Advance Stocks – No of Decline Stocks) + Breadth Line Value of the Previous day. When the number of advance stocks exceeds the number of the decline stocks then the breadth line will rise and vice versa.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Accounting, Glossary Terms, Health Economics, Investing | Tagged: breadth line value, fear greed index, fear index, market breadth, stock market breadth, stock price breadth | Leave a comment »