By Reporters

***

***

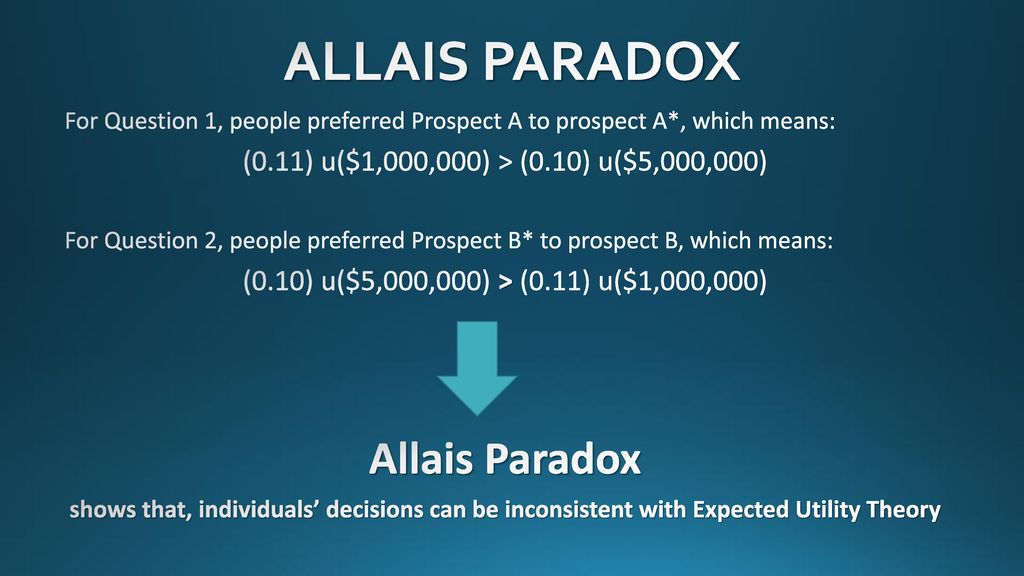

Allais Paradox is a change in a possible outcome that is shared by different alternatives affects people’s choices among those alternatives, in contradiction with expected utility theory.

The Allais paradox is a choice problem designed by Maurice Allais 1953 to show an inconsistency of actual observed choices with the predictions of expected utility theory theory.

According to colleague Dan Ariely PhD, the Allais paradox demonstrates that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox.

COMMENTS APPRECIATED

Like and Subscribe

***

***

Filed under: Ethics, Experts Invited, Glossary Terms, LifeStyle, mental health | Tagged: Allais, Allais Maurice, Allais paradox, anxiety, Dan Ariely PhD, mental health, paradox, philosophy, psychology, utility theory |

Leave a comment