Investing at Home or Away?

Recently a client asked me why we bother with investing in international markets. After all, the S&P 500 has done quite well in the last year. Indeed, it has outperformed foreign markets three years in a row, and by a huge margin to boot.

Take 2014 for example-the S&P 500 was up 13%, while the international markets on aggregate were down 5%. So; why then?

Table

Well, let’s look at this table

***

***

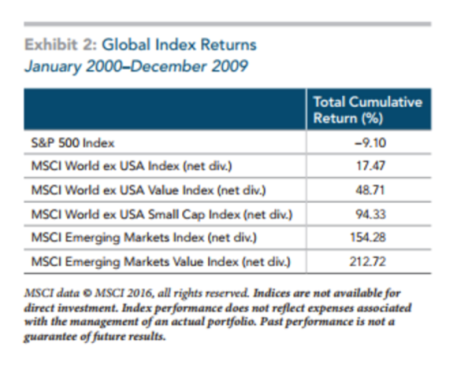

The Lost Decade

The decade between 2000 and 2009 is what investors call “The Lost Decade,” but only if you invested solely in the S&P 500. If you had owned a globally diversified portfolio, the decade would not have been lost. In fact, after The Lost Decade, some of my clients asked me “Why bother with investing in US stocks at all?”

Assessment

My answers then and now are the same: because we don’t know what the future will bring and we don’t know which market will do best or worst, so we need a globally diversified portfolio to limit our risk of falling victim to another lost decade.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

Filed under: Investing, Portfolio Management | Tagged: Global investing, globally diversified portfolio, Michael Zhuang, The Lost Decade |

GLOBAL Stocks

The International Monetary Fund is predicting more pain for global stocks as central banks around the world tighten their monetary policies to curb rising inflation.

Xia

LikeLike