Basic Financial Concepts

By Timothy J. McIntosh; CFP™ MBA MPH CMP [hon]

By Jeffery S. Coons; PhD CFA

By Dr. David E. Marcinko; MBA CMP™

Passive investing is a monetary plan in which an investor invests in accordance with a pre-determined strategy that doesn’t necessitate any forecasting of the economy or an individual company’s prospects.

Premise

The primary premise is to minimize investing fees and to avoid the unpleasant consequences of failing to correctly predict the future. The most accepted method to invest passively is to mimic the performance of a particular index. Investors typically do this today by purchasing one or more ‘index funds’. By tracking an index, an investor will achieve solid diversification with low expenses. Thus, a physician-investor could potentially earn a higher rate of return than an investor paying higher management fees.

Passive management is most widespread in the stock markets. But; with the explosion of exchange traded funds on the major exchanges, index investing has become more popular in other categories of investing. There are now literally hundreds of different index funds.

***

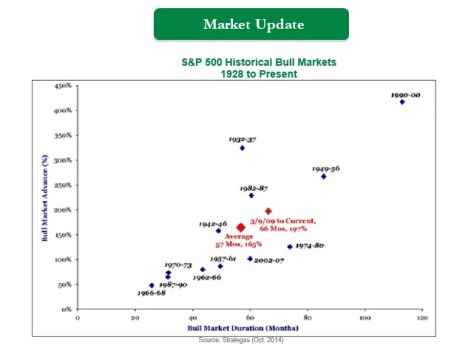

[Domestic Bull Markets – Historical USA]

***

Passive management is based upon the Efficient Market Hypothesis theory. The Efficient Market Hypothesis (EMH) states that securities are fairly priced based on information regarding their underlying cash flows and that investors should not anticipate to consistently out-perform the market over the long-term.

The Efficient Market Hypothesis evolved in the 1960s from the Ph.D. dissertation of Eugene Fama. Fama persuasively made the case that in an active market that includes many well-informed and intelligent investors, securities will be appropriately priced and reflect all available information. If a market is efficient [even emerging and/or world markets], no information or analysis can be expected to result in outperformance of an appropriate benchmark.

***

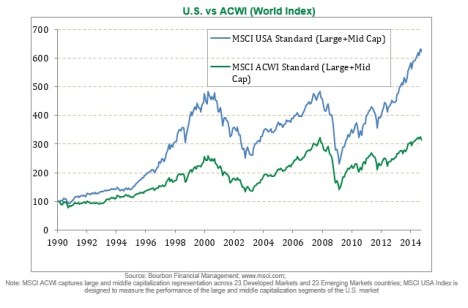

[USA versus World Index]

***

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

More:

- The Active v. Passive Investing Dichotomy

- The “Life Cycle Investment Hypothesis”

- Is Passive Investing Right for You?

- Are Capital Markets Efficient?

- Enter the CMPs

- Sample iMBA Engagements

- Foreword Dyken MD MBA

The Author

Timothy J. McIntosh is Chief Investment Officer and founder of SIPCO. As chairman of the firm’s investment committee, he oversees all aspects of major client accounts and serves as lead portfolio manager for the firm’s equity and bond portfolios. Mr. McIntosh was a Professor of Finance at Eckerd College from 1998 to 2008. He is the author of The Bear Market Survival Guide and the The Sector Strategist. He is featured in publications like the Wall Street Journal, New York Times, USA Today, Investment Advisor, Fortune, MD News, Tampa Doctor’s Life, and The St. Petersburg Times. He has been recognized as a Five Star Wealth Manager in Texas Monthly magazine; and continuously named as Medical Economics’ “Best Financial Advisors for Physicians since 2004. And, he is a contributor to SeekingAlpha.com., a premier website of investment opinion. Mr. McIntosh earned a Bachelor of Science Degree in Economics from Florida State University; Master of Business Administration (M.B.A) degree from the University of Sarasota; Master of Public Health Degree (M.P.H) from the University of South Florida and is a CERTIFIED FINANCIAL PLANNER® practitioner. His previous experience includes employment with Blue Cross/Blue Shield of Florida, Enterprise Leasing Company, and the United States Army Military Intelligence.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

Filed under: Investing | Tagged: certified medical planner, David Edward Marcinko, efficient market hypothesis, EMH, ETFs, exchange-traded funds, Jeff Coons PhD CFA, passive investing, Timothy J. McIntosh |

PM and the EMH

Passive management is based upon the Efficient Market Hypothesis theory.

The Efficient Market Hypothesis (EMH) states that securities are fairly priced based on information regarding their underlying cash flows and that investors should not anticipate to consistently out-perform the market over the long-term.

The Efficient Market Hypothesis evolved in the 1960s from the Ph.D. dissertation of Eugene Fama. Fama persuasively made the case that in an active market that includes many well-informed and intelligent investors, securities will be appropriately priced and reflect all available information. If a market is efficient, no information or analysis can be expected to result in outperformance of an appropriate benchmark. There are three distinct forms of EMH that vary by the type of information that is reflected in a security’s price:

• Weak Form

This form holds that investors will not be able to use historical data to earn superior returns on a consistent basis. In other words, the financial markets price securities in a manner that fully reflects all information contained in past prices.

• Semi-Strong Form

This form asserts that security prices fully reflect all publicly available information. Therefore, investors cannot consistently earn above normal returns based solely on publicly available information, such as earnings, dividend, and sales data.

• Strong Form

This form states that the financial markets price securities such that, all information (public and non-public) is fully reflected in the securities price; investors should not expect to earn superior returns on a consistent basis, no matter what insight or research they may bring to the table.

Assessment

While a rich literature has been established regarding whether EMH actually applies in any of its three forms in real world markets, probably the most difficult evidence to overcome for backers of EMH is the existence of a vibrant money management and mutual fund industry charging value-added fees for their services.

Dr. David Edward Marcinko MBA CMP™

LikeLike

You are your own worst investing enemy

The biggest risk investors face isn’t a recession, a bear market, the Federal Reserve or their least favorite political party.

It is their own emotions and biases, and the destructive behaviors they cause.

You can be the best stock picker in the world, capable of finding tomorrow’s winning businesses before anyone else. But if you panic and sell during the next bear market, none of it will matter.

You can be armed with an M.B.A. and have 40 years before retirement to let your savings compound into a fortune. But if you have a gambling mentality and you day-trade penny stocks, your outlook seems dismal.

You can be a mathematical genius, building the most sophisticated stock-market forecasting models. But if you don’t understand the limits of your intelligence, you are on your way to disaster.

There aren’t many iron rules of investing, but one of them is that no amount of brain power can compensate for behavioral errors. Figure out what mistakes you are prone to make and embrace strategies that limit the risk.

Lou

LikeLike

Passive Investing

The Dying Business of Picking Stocks

http://www.msn.com/en-us/money/savingandinvesting/the-dying-business-of-picking-stocks/ar-AAj3tNj?li=BBnbfcN

Dr. David Marcinko MBA CMP®

LikeLike

Leverage for the Long Run

The tremendous wealth generation from stocks makes a buy and hold strategy of the S&P 500 extremely difficult to beat.

Beyond this, the Efficient Market Hypothesis maintains that it is impossible to consistently outperform the market while Random Walk theory asserts using technical indicators is futile.

Michael A. Gayed CFA

LikeLike

[…] More: https://medicalexecutivepost.com/2015/03/19/more-on-passive-investing-for-physicians/ […]

LikeLike

[…] FROM: Active to Passive Investing? | The Leading Business Education Network for Doctors, Financial Advisors and Health Industry Consultants on More on “Passive Investing” for Physicians […]

LikeLike