A Normal or Strategic Business Imperative for Doctors?

If you, or your medical practice, can’t qualify for a traditional business loan, or if you don’t have time to wait for those funds, there are other alternative financing options that might be the answer — especially when those funds will equal a big return.

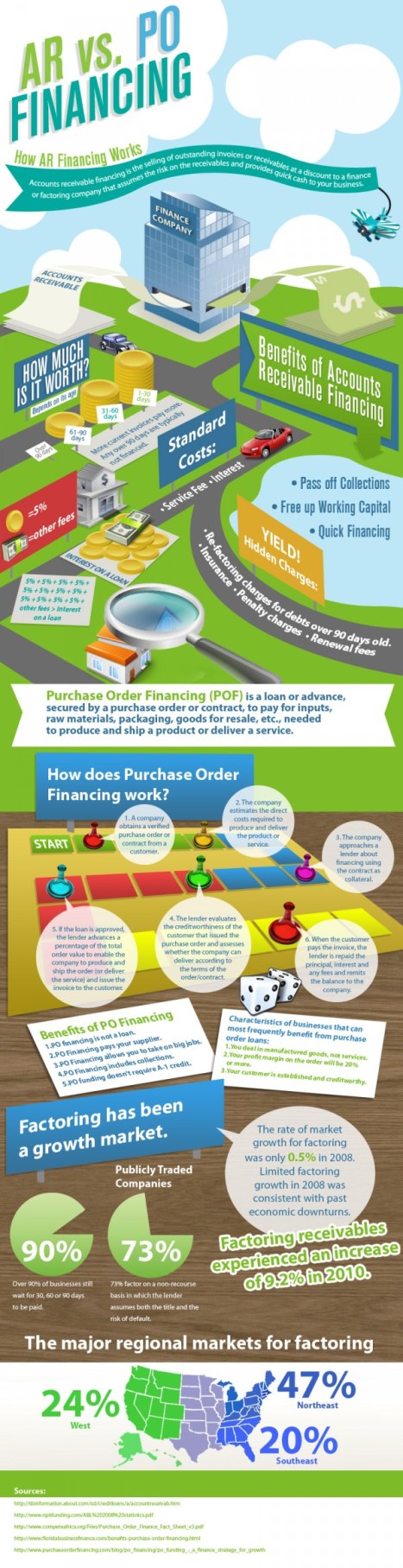

AR and PO financing (accounts receivable and purchase order financing) are two choices for business owners, and medical practices, when they need immediate capital, or have lower credit scores.

Assessment: This graphic should help decide if AR or PO financing is right for you.

Source: Dan Bischoff

Conclusion

And so, your thoughts and comments on this ME-P are appreciated. Please review our top-left column, and top-right sidebar materials, links, URLs

and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Our Other Print Books and Related Information Sources:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: Healthcare Finance, Practice Management | Tagged: accounts receivable financing, DME, How Healthcare AR and PO Financing Works, puchase order financing, www.healthcarefinancials.com |

More On ARs … Timeline to Payment

I work in an MDs office collecting ARs. In my experience, primary care insurance claims generally take about 30-45 days to pay. Some secondary insurances still require manual claims submission following the receipt of the EOB from the primary insurance. The secondary insurance may then take another 30-45 days to pay the remaining portion of the bill.

So, already waiting for that secondary payment, we are at nearly 90 days on a small portion of your AR claims’ balances. Then, there may be a patient balance remaining that is nearly 90 days old before the first patient bill has been mailed.

Generally, it is best practice to send patients 3 bills (one per month) over the course of 3 months or approximately 90 days before considering a collections company and removing the balance from active AR. That means your 60-121+ timeline cannot be zero for ARs. If they are, you may have a problem.

What problem?

Too many ARs means you are not collecting enough. Too few ARs means the MD is not working enough.

Both are BAD for any medical practice!

Andrea

LikeLike