By Staff Reporters

***

What is a tax deduction?

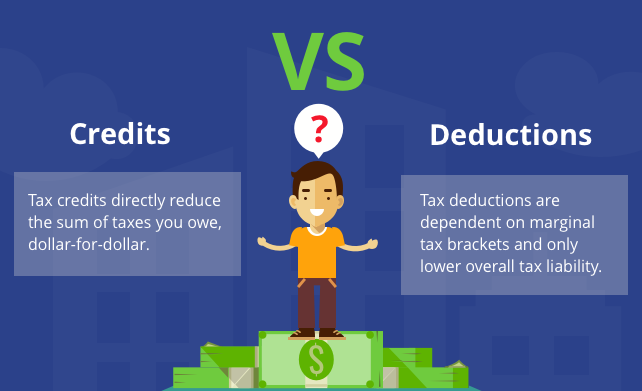

A deduction reduces the amount of income you pay taxes on, which means you could pay less in taxes. You subtract deductions from your income before calculating how much taxes you owe. How much a deduction saves you depends on your income tax bracket.

To calculate how much a deduction could reduce your taxes, you multiply the amount of the deduction by your marginal tax rate. For example, if a deduction is worth $5,000 and you are in the 10% tax bracket (the lowest), the deduction would reduce your taxes by $500.

A deduction’s value to you is tied to your tax rate. So if you’re paying a higher tax rate, you can reap more of a deduction’s benefit. The lower your tax rate, the less benefit a deduction will have for you. Imagine that you take a $5,000 deduction, but you’re in the 35% tax bracket — the second highest. Now you’re saving $1,750 in taxes.

CITE: https://www.r2library.com/Resource/Title/082610254

What is a tax credit?

On the other hand, a credit is a dollar-for-dollar reduction in the amount of tax you owe. For example, if you qualify for a $1,000 tax credit of some kind and owe $5,000 in taxes, that credit will reduce your tax burden to $4,000.

***

But – Do Not Claim Too Many Tax Deductions

Deductions are enticing to taxpayers because they can reduce the amount of your income before you calculate the tax you owe, which in turn might significantly lower how much you have to pay in taxes or increase your refund. But that doesn’t mean you should go wild writing things off on your tax returns, as experts say claiming too many deductions is the most common reason people end up getting audited by the IRS.

Don’t try writing off deductions that are no longer accepted by the IRS. The tax code has changed over the years, and there are some things the tax agency no longer recognizes. You should remember that some of the tax write-offs were terminated by the IRS, including deductions on alimony, moving expenses, and any expenses related to investing, hobbies, and tax preparation.

***

Comments Appreciated

THANK YOU

Subscribe to the Medical Executive-Post

***

***

Filed under: Accounting, Taxation | Tagged: Accounting, credit, deduction, S&P 500, tax code, tax credits, tax deductions, Taxation | Leave a comment »