“Knowingly and Willfully”

[By Carol S. Miller RN MBA]

Individuals and entities are prohibited from “knowingly and willfully” making false statements or presentations in applying for benefits or payments under all federal and state healthcare programs. Individuals also are prohibited from fraudulently concealing or failing to disclose knowledge of an event relating to an initial or continued right to payments.

There is also prohibition against knowingly and willingly soliciting or receiving any remuneration (including any kickbacks, bribes, or rebates) directly or indirectly, in cash or in kind, in exchange for referrals. Violations may result in felony convictions with penalties including imprisonment and fines.

Individuals or entities can be excluded from Medicare and Medicaid and more than 200 other federal healthcare programs for a minimum of five years if there is one prior fraud or abuse conviction. Thee exclusions last for ten years and if there are two prior convictions, the exclusion can become permanent. The minimum period of discretionary exclusion is three years, unless DHHS determines that a different period is appropriate.

It is just as important to communicate to the employees when laws or regulations do not impact your organization, such as the Family Medical Leave Act (FMLA), the employment provisions of the Americans with Disabilities Act (ADA) or continuation of health benefits under the Consolidated Omnibus Budget Reconciliation Act (COBRA). These benefits apply only to organization with a specific number of employees, so smaller organizations are not necessarily required to offer these benefits.

***

***

However, the Patient Protection and Affordable Care Act (PPACA) provides a slightly different situation for the provider’s practice. PP-ACA mandated coverage, penalizing employers who failed to provide it, and creating mechanisms for people to pool risk and buy insurance collectively.

Further the Act stated: 1) all individuals not covered by an employer sponsored health plan, Medicare or Medicaid or other public insurance programs such as Tricare to secure an approved private-insurance policy or pay a penalty, unless the individual has a financial hardship or is a member of a recognized religious sect exempted by the Internal Revenue Service and 2) businesses, including larger medical practices which employ 50 or more people but do not offer health insurance to their full-time employees will pay a tax penalty if the government has subsidized a full-time employee’s healthcare through tax deductions or other means.

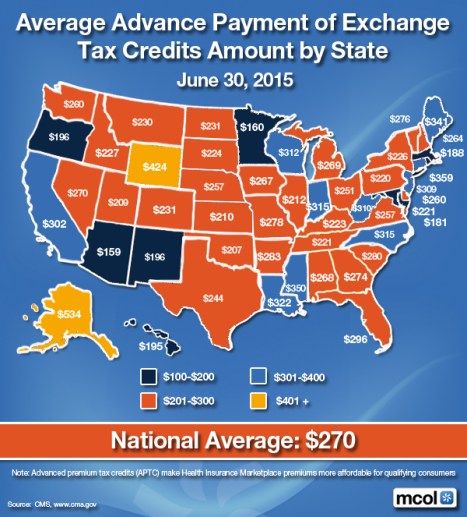

This is known as the employer mandate. What this means for the provider’s practice is that if the provider is offering healthcare benefits to their staff, the coverage needs to be comparable with the requirements stated in the PP-ACA and if the practice is not offering healthcare benefits, then the practice must direct the individual to one of the Health Insurance Exchanges that are offering individual coverage plans.

More:

- Catching Health Care Fraud in “Real-Time”

- On the FBI’s Medicare Fraud Strike Forces

- Understanding the Spoils of Healthcare Fraud and Abuse

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

[PHYSICIAN FOCUSED FINANCIAL PLANNING AND RISK MANAGEMENT COMPANION TEXTBOOK SET]

***

Filed under: Health Insurance, Risk Management | Tagged: ACA, carol s. miller, employer mandate, Federal Healthcare Programs, Health Insurance Exchanges | 3 Comments »