What is the Dow Theory?

By Staff Reporters

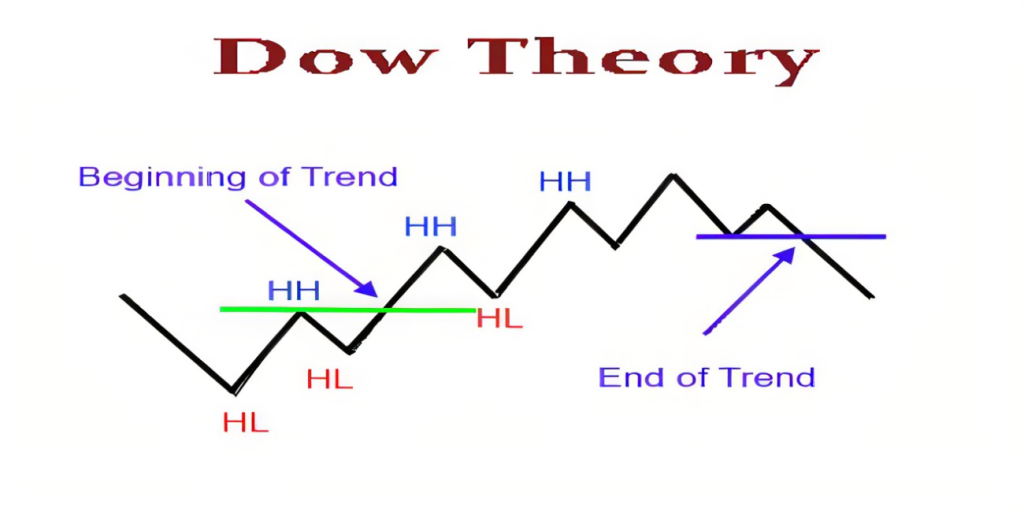

Pioneered by Charles H. Dow, one of the founders of The Wall Street Journal and Dow Jones & Co., and the publisher of MarketWatch, the theory states that if two stock-market averages, most commonly the Dow industrials and transport gauges, reach notable new highs within the same short period, then the broader market is likely headed higher.

It also was one of the first theories that sought to codify a methodology for prognosticating where the market might be headed in the intermediate future. For more than a century, it’s been a staple in the repertoire of technical strategists, who aim to glean insights through analysis of stock-market charts and indicators.

CITE: https://www.r2library.com/Resource

Dow Theory has lost some of its luster in modern times, especially as the Dow has taken a backseat in recent years to the S&P 500 and high flying tech-heavy indexes like the NASDAQ Composite and NASDAQ-100 critics also have lambasted it as overly simplistic.

MORE: https://medicalexecutivepost.com/2022/06/23/the-technicians/

But proponents of the technical Dow Theory can still point to a wealth of historical data showing it generally works as a buy signal, especially if its broadened to include other indexes like the now-dominant S&P 500.

MORE: https://www.investopedia.com/terms/d/dowtheory.asp

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Experts Invited, Financial Planning, Investing | Tagged: charts, DJIA, DOW, DOW Theory, MarkwtWatch, NSDAQ, S&P 500, Wall Street Journal |

Leave a comment