[By Staff Reporters]

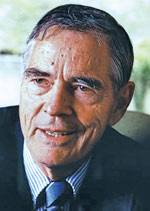

Jack Treynor Pioneered Modern Investment Theory; Dead at 86

***

***

Jack Lawrence Treynor (February 21, 1930 – May 11, 2016) was the President of Treynor Capital Management, Palos Verdes Estates, CA. He was a Senior Editor and Advisory Board member of the Journal of Investment Management, and was a Senior Fellow of the Institute for Quantitative Research in Finance. He served for many years as the editor of the CFA Institute‘s Financial Analysts Journal.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

Filed under: Financial Planning, LifeStyle | Tagged: Jack Treynor, Treynor Index |

What is the ‘Treynor Ratio’?

A ratio developed by Jack Treynor that measures returns earned in excess of that which could have been earned on a riskless investment per each unit of market risk.

The Treynor ratio is calculated as:

(Average Return of the Portfolio – Average Return of the Risk-Free Rate) / Beta of the Portfolio

BREAKING DOWN ‘Treynor Ratio’

In other words, the Treynor ratio is a risk-adjusted measure of return based on systematic risk. It is similar to the Sharpe ratio, with the difference being that the Treynor ratio uses beta as the measurement of volatility.

Also known as the “reward-to-volatility ratio”.

Clarence

LikeLike