Self Directed IRA investments

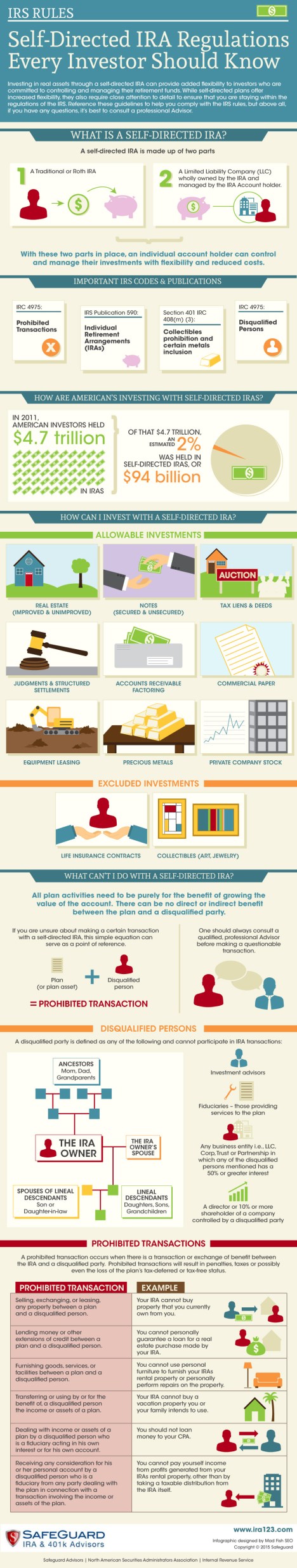

When considering Self Directed IRA investments, it’s important to understand the regulations. These include prohibited transactions and people, among other rules. Often, immediate family members are excluded in participating in transactions, including living in property purchased by your IRA.

There are also heavy restrictions on the investments your IRA can invest in, including collectibles and life insurance. Before making decisions surrounding your retirement account, be sure to consult an expert who can help you plan your investment. Safeguard advisors can answer your questions about Self Directed IRA regulations to make sure your retirement account grows as a result of your investments.

***

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

More:

- Physician Creditor Protection for IRAs, Annuities and Insurance for 2014

- A New IRA Withdrawal Limit Proposal

Even More:

- http://blogs.marketwatch.com/encore/2013/04/10/obama-budget-would-cap-iras-at-3-million/

- http://www.bloomberg.com/news/2013-04-08/romney-s-ira-obama-target-for-revenue-with-3-million-cap.html

- http://www.forbes.com/sites/kellyphillipserb/2013/04/08/does-president-obama-want-to-tax-your-retirement/

- http://thehill.com/blogs/on-the-money/domestic-taxes/292071-obama-budget-to-target-wealthy-iras

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

Filed under: Retirement and Benefits | Tagged: Safeguard advisors, Self-Directed IRA |

IRA Losses

You can claim losses on traditional and Roth IRAs as a miscellaneous itemized deduction, but only in very rare cases.

For Roth IRAs, all accounts must be closed, including those that earned a profit. Traditional IRAs don’t need to be closed and are treated separately. You must show a loss from your tax base to qualify.

Rufus

LikeLike

New tax bill would remove age limit on IRA contributions

House Ways and Means Committee Chair Kevin Brady, R-Texas, just unveiled legislation that would make changes to the IRS and rules on retirement savings.

The bill includes provisions that would allow retirees to continue contributing to their IRAs past the age of 70 1/2, but would still require them to take mandatory distributions as soon as they reach that age. The legislation would also ease the rules for business owners in setting up multiple employer plans and in offering annuity options to their employees.

Dr. David Edward Marcinko MBA

LikeLike