The 30th all-time high for the S&P 500 in 2014 alone

By Lon Jefferies MBA CFP®

Last week, the S&P 500 achieved an all-time high, exceeding the 2,000 level for the first time ever during intra-day trading. The index ended the day at 2,001 almost exactly triple the market low of 666 achieved in March of 2009 during the global financial crises. Yesterday, it reached another high; 2,007.

Last week, the S&P 500 achieved an all-time high, exceeding the 2,000 level for the first time ever during intra-day trading. The index ended the day at 2,001 almost exactly triple the market low of 666 achieved in March of 2009 during the global financial crises. Yesterday, it reached another high; 2,007.

Believe it or not, this was the 30th. all-time high for the S&P 500 in 2014 alone.

Fearing the Phrase

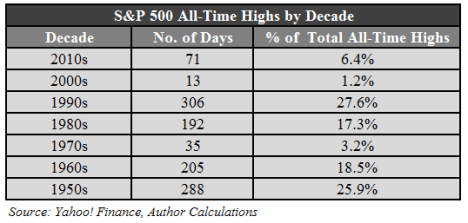

Many investors fear the phrase “all-time high,” believing it implies stocks have already captured the gains available in the market and that there is nowhere for the value of these equities to go but down. However, all-time highs are perfectly normal in the stock market. In fact, since 1950 there have been over 1,100 new all-time closing highs achieved by the S&P 500. That is 6.8% of all trading days or roughly 1 out of every 15 days the market is open that it’s closed at a new high level!

In addition, while it is true the S&P 500 hit a new nominal high, it is still significantly under its high when adjusted for inflation. In fact, Will Hausman, an economics professor at the College of William and Mary, calculates that the S&P 500 hit its true high – its inflation-adjusted high – of 2,120 on January 14, 1999. By that metric, 15 years ago the S&P 500 was 10% higher than it is now. Put that way, it is possible the market could continue to appreciate at its current pace without valuations exceeding their historical peak.

***

***

Market highs not necessarily bad

My goal is to point out that the phrase “all-time high” isn’t necessarily bad when relating to the stock market.

Now, just because stocks are at all-time high levels certainly doesn’t make them immune to a decline or even a crash. Stocks were at all-time high levels before the tech bubble of 2000 popped, and if by measured by the NASDAQ index, the market still hasn’t fully recovered. However, stocks aren’t required to decline just because they are at levels unattained before.

Assessment

Physicians and all investors don’t need to feel the need to sell their equity investments or not invest new dollars in the market just because the S&P 500 is at a number we haven’t yet seen. My favorite quote regarding the subject comes from financial columnist Nick Murray: “If you think the market is “too high,” wait until you see it 20 years from now.”

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- DICTIONARIES: http://www.springerpub.com/Search/marcinko

- PHYSICIANS: www.MedicalBusinessAdvisors.com

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- BLOG: www.MedicalExecutivePost.com

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Investing | Tagged: Lon Jefferies MBA CFP®, Stock Market Highs |

LON,

The US stock market finished the week higher, the S&P 500 added 0.5%, up 0.2% on the week, the Russell 2000 (+0.3%) fell 0.2% on the week.

Friday’s NFPs report for August showed the addition of 142,000 payrolls, the consensus expected 223,000. This very negative number was followed by a rally in equity futures with participants viewing the report as an argument in favor of the Fed potentially delaying its 1st interest rate hike.

Stock indices slipped, but the S&P 500 found support near 1990, which served as resistance turned support over the past 2 wks. The benchmark index tested the mark around 10:45a EDT and spent the session in a steady climb to new highs.

Healthcare (+0.6%), contributed to some weakness, the iShares Nasdaq Biotechnology ETF (NYSEArca:IBB) 270.60, -0.32 shed 0.1% after being down as much as 2.0%. The ETF logged its 4th decliner running, off 2.2% on the week.

Jerico

LikeLike

Is Wall Street running out of bears?

http://money.msn.com/top-stocks/post–is-wall-street-running-out-of-bears.

One of the most downbeat strategists watching the market flips, leaving few left to sound notes of caution.

And, Goldman is bullish, too.

http://money.msn.com/top-stocks/post–goldman-is-again-bullish-on-stocks

Dexter

LikeLike

The market grows more treacherous

Stocks drift lower and bonds are hit as investors await the Fed.

http://money.msn.com/top-stocks/post–the-market-grows-more-treacherous

So Dexter – forget Goldman – and prepare for higher volatility in the weeks, ahead.

Jerico

LikeLike

New Stock Market Highs – Yet Again,

We reached the 17th. record for the DJIA and 34th. for the S&P today, for 2014.

http://money.msn.com/business-news/article.aspx?feed=AP&date=20140918&id=17942886

Yippie?

Dexter

LikeLike

On Interest Rate Trends and Market Highs

Sam Stovall, S&P Capital IQ’s U.S. equity strategist, recently tracked Fed interest rate hikes going back to the end of World War II.

“And there, market history suggests long-term optimism but short-term caution. In 13 of the 16 times the Fed raised rates, the market went into a pullback, correction or bear market” in the six months before the rate hikes began”

But, this is useless data. We have to consider not just the 16 times the FED raised Rates but how similar were the conditions during those periods of rate rising.

So, I doubt we will find them being this low for this long along with a Debt to GDP ratio this high. Then, as the economy is far more globally connected, what impact will global conditions have. Then you add in the Fed’s balance sheet levels compared to then.

And, to say that 13 out of 16 times this happen only has meaning if we had almost identical conditions. We are in uncharted Territory. The past is useless in the case; especially with the current international geo-political strife.

What say yea; esteemed ME-P readers?

Dr. David Edward Marcinko MBA CMP™

http://www.CertifiedMedicalPlanner.org

LikeLike

The market finally snaps?

Well said, Dr. Marcinko, but the market took a beating today on Apple, Russia and a collapse in bonds. And, a correction may be in the wings.

http://money.msn.com/top-stocks/post–the-market-finally-snaps

So, is this the “big one”?

Benton

LikeLike

Investors gird for scarier days in markets

Ben – Volatility has suddenly returned to U.S. stocks, and for the first time all year it doesn’t appear that the weakness in equities will go away quietly in the span of a few days.

http://www.msn.com/en-us/money/markets/investors-gird-for-scarier-days-in-markets/ar-BB8Y7JY

Stu

LikeLike

Remember the Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as Black Tuesday or the Stock Market Crash of 1929, began in late October 1929 and was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its fallout.

http://en.wikipedia.org/wiki/Wall_Street_Crash_of_1929

The crash signalled the beginning of the 10-year Great Depression that affected all Western industrialized countries.

And today, the Fed is likely to announce that it will no longer add to its holdings of Treasury bonds and mortgage-backed securities, effectively ending a program that at its peak pumped $85 billion a month into the financial system.

Remember and Beware!

Simon

LikeLike

Here we go again!

Lon – The Standard & Poor’s 500 Index advanced 1.2 percent to 2,017.73 at 4 p.m. in New York, topping its previous all-time closing high of 2,011.36 on Sept. 18th.

The Dow Jones Industrial Average rallied 193.62 points, or 1.1 percent, to 17,389.04, also an all-time high.

http://www.msn.com/en-us/money/markets/sandp-500-rallies-to-record-after-japan-boosts-stimulus/ar-BBcb3x4

The Nasdaq Composite (CCMP) Index surged 1.4 percent to the highest since March 2000.

Bruce

LikeLike

U.S. Stock-Index Futures Rise as Republicans Win Senate Majority

http://www.msn.com/en-us/money/topstocks/us-stock-index-futures-rise-as-republicans-win-senate-majority/ar-BBd3um6

So, is this the second leg of the bull market?

Xavier

LikeLike

New Highs – Again

Amid domestic economic confidence?

http://www.msn.com/en-us/money/inside-the-ticker/us-stocks-climb-to-record-levels-amid-economic-optimism/ar-BBfVYPf?ocid=iehp

DJIA = 17,827.75

Bruce

LikeLike

DECEMBER 31st, 2014

The U.S. equity markets gave up early gains and closed the final trading session of 2014 in the red.

Identifying the catalyst for the change in price direction may prove a futile endeavor as volume was on the lighter side with all U.S. markets set to be shuttered tomorrow in observance of New Year’s Day and as the domestic bond markets traded in a shortened session.

Divergent data from the domestic economic docket showed disappointing reads on jobless claims and regional manufacturing activity and a better-than-expected November pending home sales report.

Treasuries were modestly higher, while notable news from the equity front was nearly nonexistent

HAPPY NEW YEAR TO ALL ME-P READERS!

Dr. David Edward Marcinko MBA

http://www.CertifiedMedicalPlanner.org

LikeLike