Explaining Your Paycheck

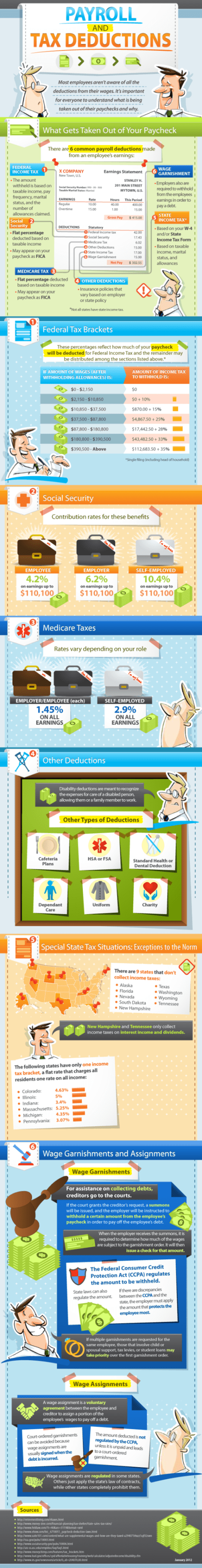

This infographic takes a dry topic, unknown to some employed medical professionals and healthcare workers, and makes it interesting by visually walking us through a paycheck.

The design allows us to understand all the different deductions that may come out prior to the final amount that makes it to your bank account.

Importance

Most American [healthcare] workers aren’t aware of the factors that determine how much is deducted from their paychecks, yet it’s important to have that understanding so you can speak up about any errors.

The Deductions

So what exactly is that payroll software deducting from your paycheck?

Typical deductions include federal income tax, OASDI, Medicare tax, disability and state income tax. Your tax bracket will range from 10% to 35% depending on your amount of taxable income. Medicare tax rates will be different depending on whether you work for a hospital, clinic or are a self-employed medical professional.

Assessment

At the state level, individual states handle taxes differently, with seven states charging all residents a flat tax rate and nine other states not collecting any income taxes at all.

Source: Paycor

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Our Other Print Books and Related Information Sources:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: Taxation | Tagged: disability and state income tax., federal income tax, Medicare Tax, OASDI, On Payroll and Tax Deductions, Payroll Deductions, tax bracket, tax deductions | 3 Comments »