Back to pre-financial-crisis levels?

[By Josh Velazquez CMPS]

jvelazquez@bankingunusual.com

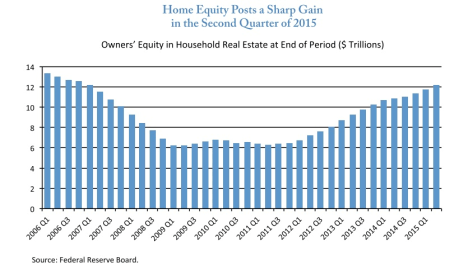

The amount of equity that Americans have in their homes has risen back up to pre-financial-crisis levels.

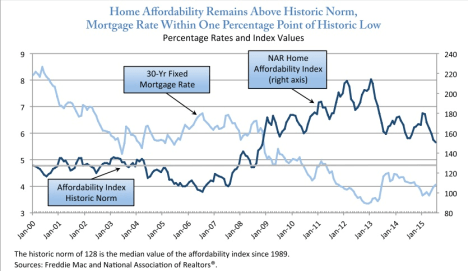

The interesting thing is that it still seems like there is room to grow because housing affordability is still very comfortably above its historical average (see chart below).

This is partly due to the fact that mortgage rates remain low and home ownership is still very affordable relative to renting a house.

***

***

Bottom line: if you or someone you know missed the opportunity to purchase a home a few years ago, it may not be too late to ride this wave higher!

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

***

***

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

[PHYSICIAN FOCUSED FINANCIAL PLANNING AND RISK MANAGEMENT COMPANION TEXTBOOK SET]

***

Filed under: Alternative Investments, Mortgage Electronic Registry System | Tagged: HARP loans, home equity, Josh Velazquez, mortgage rates | 2 Comments »