Crowding-Out

[By Staff Reporters]

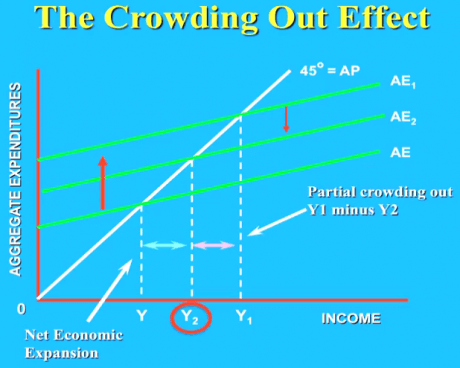

” A situation when increased interest rates lead to a reduction in private investment spending such that it dampens the initial increase of total investment spending is called crowding out effect “

***

***

The Crowding Out effect is a Monetarist criticism of expansionary fiscal policy. As seen in the multiplier effect, government spending will shift Aggregate Demand (AD) further than expected when an expansionary fiscal policy is implemented.

Assessment

However, Monetarists believe that because of this expansionary fiscal policy, the government will need to borrow money by selling government bonds. This leads to a rise in interest rates. The increased borrowing ‘crowds out’ private investing.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

***

Filed under: Health Economics | Tagged: "Crowding Out" Effect, fiscal policy, Monetarist | Leave a comment »