A TAX LOOPHOLE?

BY DR. DAVID E. MARCINKO MBA CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

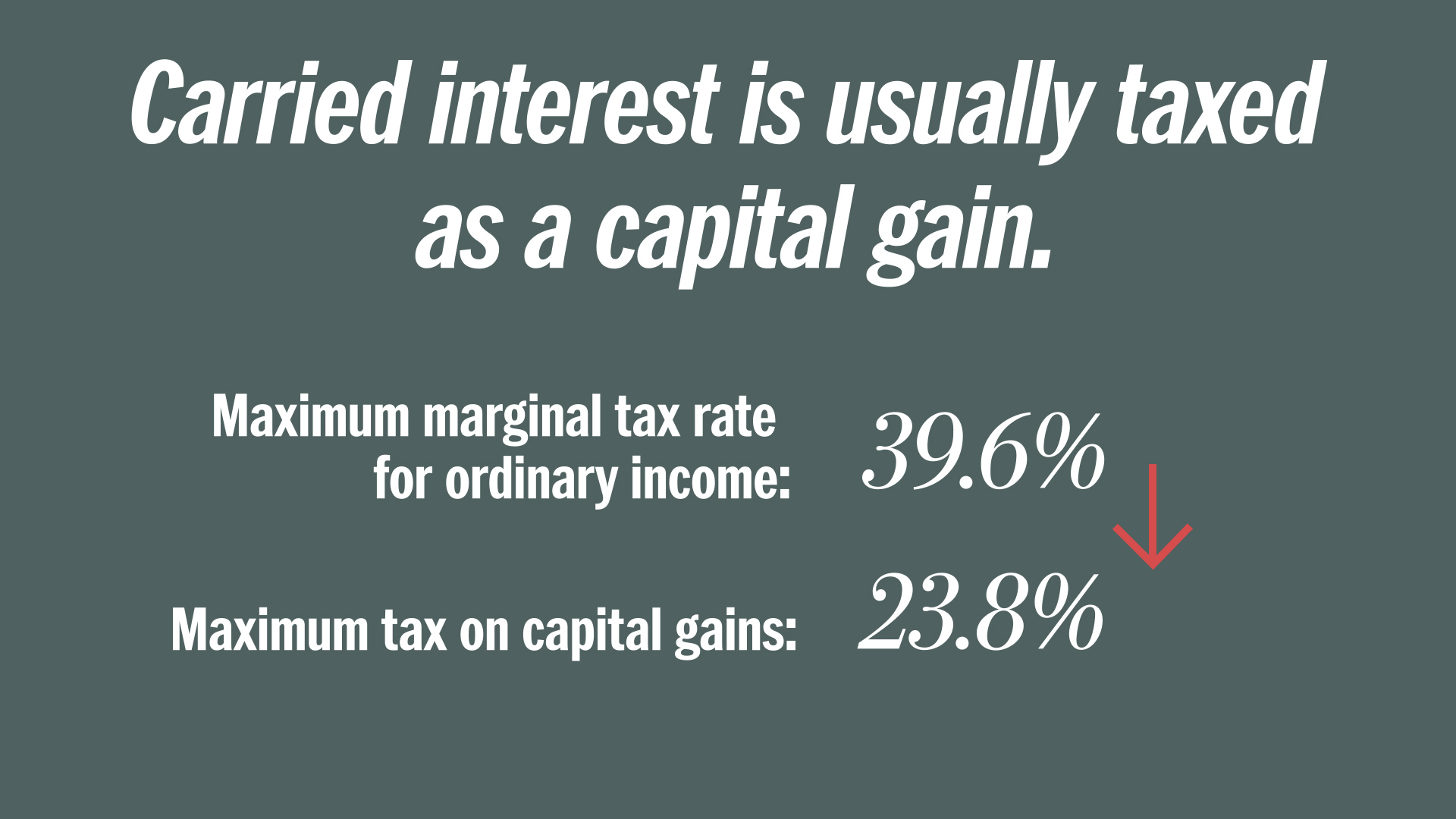

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager in excess of the amount that the manager contributes to the partnership, specifically in alternative investments (private equity and hedge funds).

CITE: https://www.r2library.com/Resource/Title/0826102549

In small businesses that are not blind pools, such as single property real estate, the investment manager often funds the business prior to the formation of the partnership. It is a performance fee, rewarding the manager for enhancing performance. The structure also takes advantage of favorable tax treatment in the United States.

However, critics of carried interest want it to be reclassified as ordinary income – not capital gains – to be taxed at the ordinary income tax rate. Private equity advocates argue that the increased tax will subdue the incentive to take the kind of risk that is necessary to invest in and manage companies to profitability.

***

***

TAXATION: https://www.taxpolicycenter.org/briefing-book/what-carried-interest-and-how-it-taxed

YOUR COMMENTS ARE APPRECIATED.

***

Thank You

***

Filed under: "Advisors Only", "Ask-an-Advisor", Accounting, Alternative Investments, Investing, Touring with Marcinko | Tagged: carried interest, carried interest loophole, carried interest tax loophole, carried interest taxation, david marcinko, financial carried interest |

Leave a comment